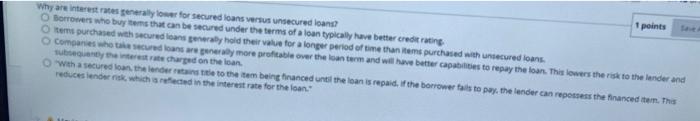

Question: 1 points Why are interest rates generally lower for secured loans versus unsecured loans? Borrowers who buys that can be secured under the terms of

1 points Why are interest rates generally lower for secured loans versus unsecured loans? Borrowers who buys that can be secured under the terms of a loan typically have better credit rating tems purchased with secured loans gay hold the value for a longer period of time than items purchased with unsecured loans Companies wholescured loans are one more profitable over the loan term and will have better capabilities to repay the loan. This lower the rise to the lender and Suther rese charged on the loan with a secured on the last to the team being financed until the loan is repaid, if the borrower tails to pay the lender can repossess the traced tem. The reduces leder which are in the interest rate for the loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts