Question: 1. preferred, common 2. equal, uneven 3. equal , uneven 4. NFV, IRR, NPV 5. NFV, IRR, NPV Time Value of Money: Uneven Cash Flows

1. preferred, common

2. equal, uneven

3. equal , uneven

4. NFV, IRR, NPV

5. NFV, IRR, NPV

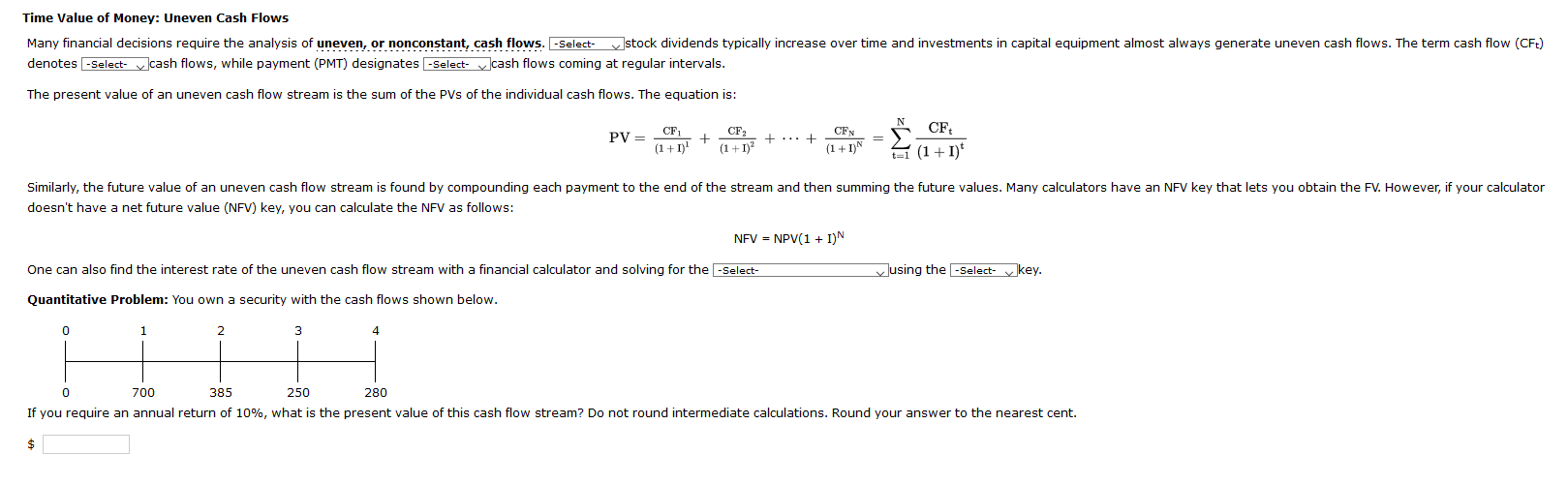

Time Value of Money: Uneven Cash Flows Many financial decisions require the analysis of uneven, or nonconstant, cash flows. -Select- vstock dividends typically increase over time and investments in capital equipment almost always generate uneven cash flows. The term cash flow (CFt) denotes -Select- cash flows, while payment (PMT) designates -Select- cash flows coming at regular intervals. The present value of an uneven cash flow stream is the sum of the PVs of the individual cash flows. The equation is: N PV = CF, (1+1) + CF (1+1) + ... + CFN (1 +T) CF t-1 (1+1) Similarly, the future value of an uneven cash flow stream is found by compounding each payment to the end of the stream and then summing the future values. Many calculators have an NFV key that lets you obtain the FV. However, if your calculator doesn't have a net future value (NFV) key, you can calculate the NFV as follows: NFV = NPV(1 + I)N One can also find the interest rate of the uneven cash flow stream with a financial calculator and solving for the -Select- using the -Select- key. Quantitative Problem: You own a security with the cash flows shown below. 0 1 2 3 4 0 700 385 250 280 If you require an annual return of 10%, what is the present value of this cash flow stream? Do not round intermediate calculations. Round your answer to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts