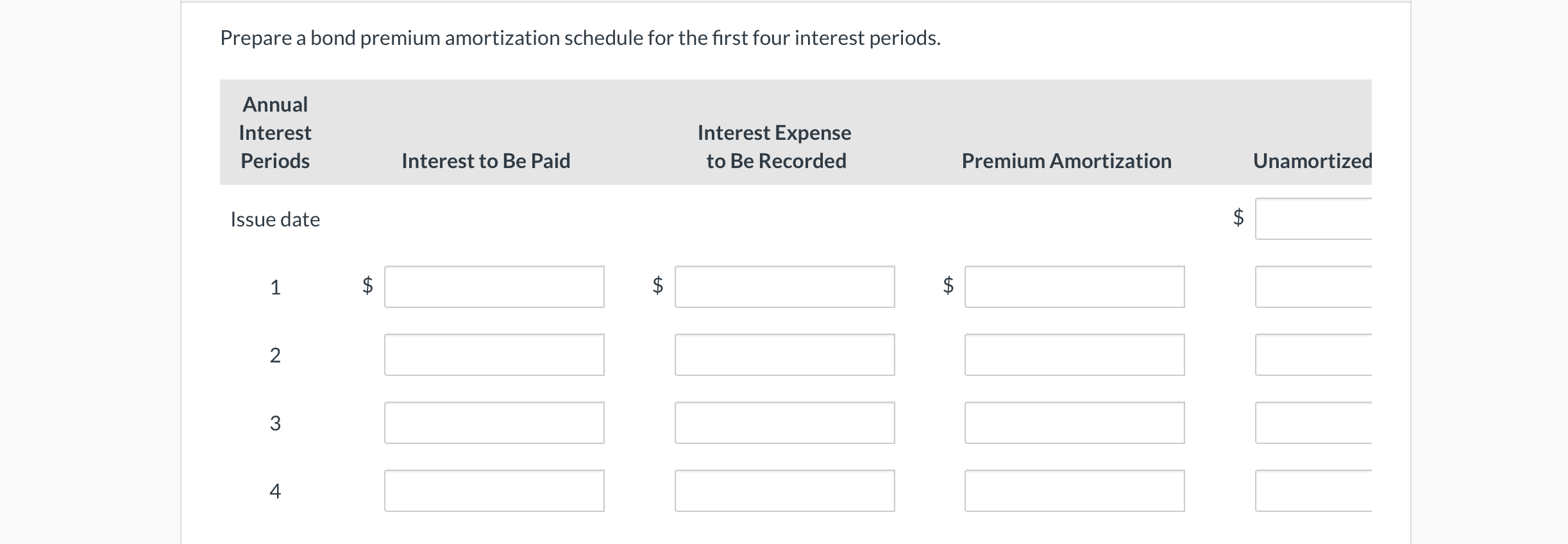

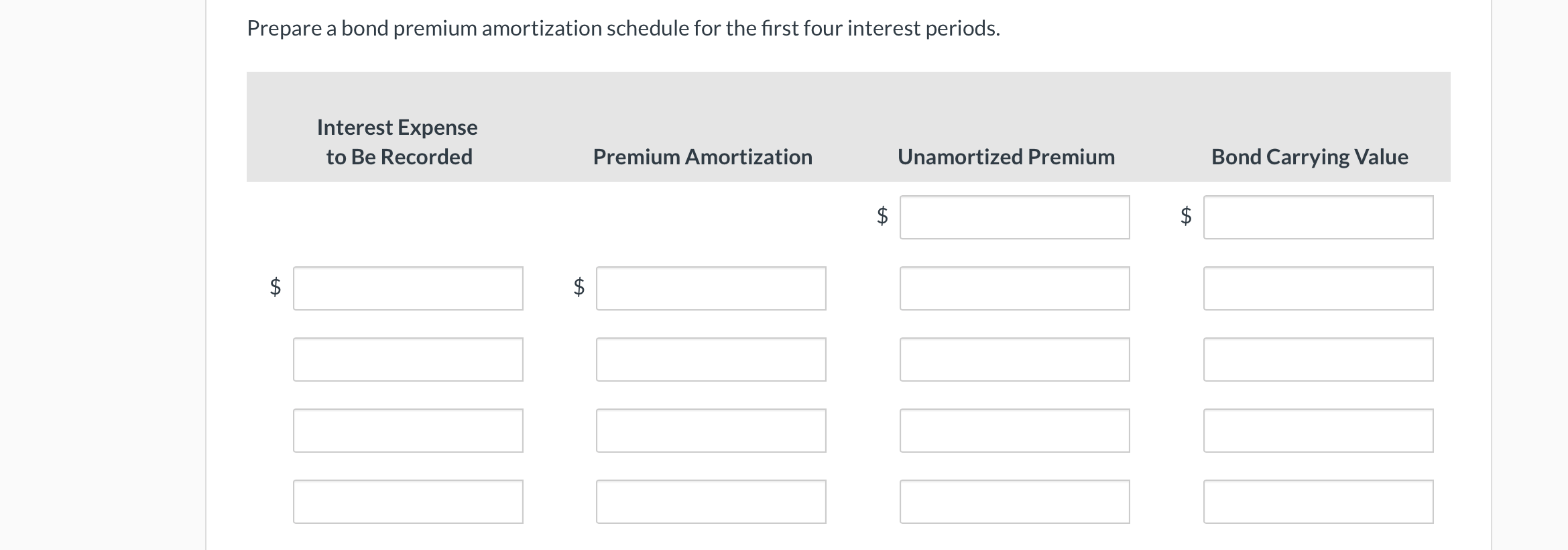

Question: 1. Prepare a bond premium amortization schedule for the first four interest periods. Wildhorse Co, sold $3,600,000, 6%, 10-year bonds on January 1, 2022. The

1. Prepare a bond premium amortization schedule for the first four interest periods.

1. Prepare a bond premium amortization schedule for the first four interest periods.

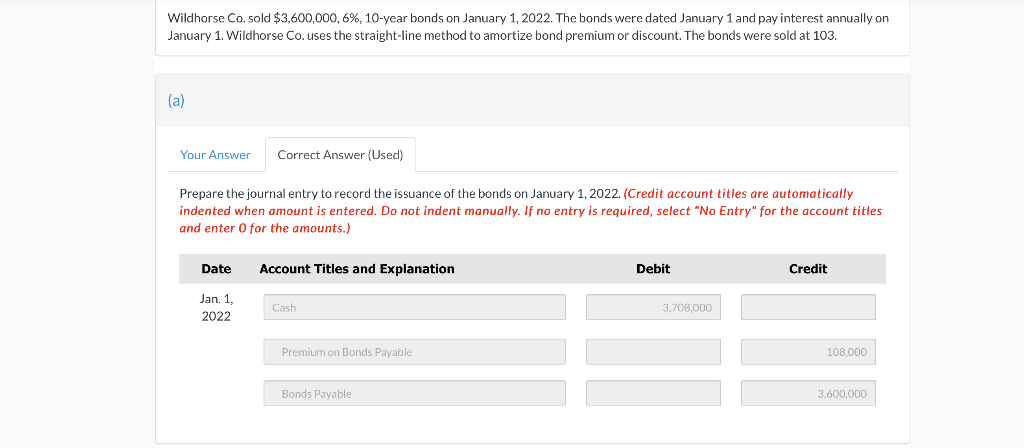

Wildhorse Co, sold $3,600,000, 6%, 10-year bonds on January 1, 2022. The bonds were dated January 1 and pay interest annually on January 1. Wildhorse Co. uses the straight-line method to amortize bond premium or discount. The bonds were sold at 103. (a) Your Answer Correct Answer (Used) Prepare the journal entry to record the issuance of the bonds on January 1, 2022. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Account Titles and Explanation Debit Credit Jan. 1, 2022 Cash 3,708,000 Premium on Bonds Payable 108,000 Bonds Payable 3,600,000 Prepare a bond premium amortization schedule for the first four interest periods. Annual Interest Periods Interest Expense to Be Recorded Interest to Be Paid Premium Amortization Unamortized Issue date ta $ 1 $ ta $ ta $ 2 3 4 Prepare a bond premium amortization schedule for the first four interest periods. Interest Expense to Be Recorded Premium Amortization Unamortized Premium Bond Carrying Value ta $ $ $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts