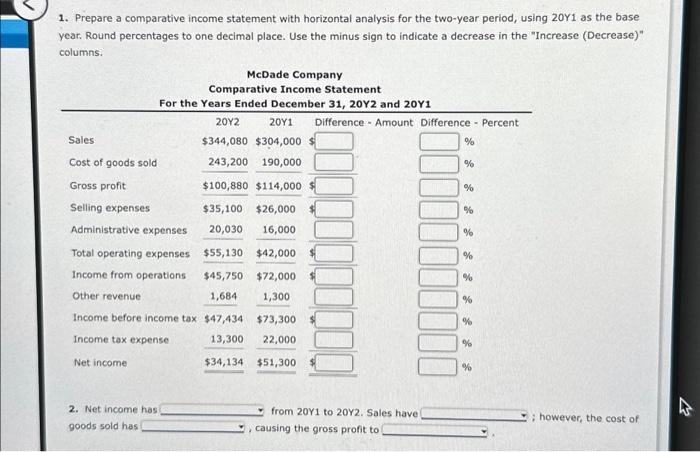

Question: 1. Prepare a comparative income statement with horizontal analysis for the two-year period, using 20Y1 as the base year. Round percentages to one decimal place.

1. Prepare a comparative income statement with horizontal analysis for the two-year period, using 20 Y1 as the base year. Round percentages to one decimal place. Use the minus sign to indicate a decrease in the "Increase (Decrease)" columns. 2. Net income has from 20 Y1 to 20Y2. Sales have goods sold has , causing the gross profit to ; however, the cost of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts