Question: 1. Prepare a depreciation schedule for each depreciation method, showing asset cost, depreciation expense, accumulated depreciation, and asset book value. 2. On Time prepares financial

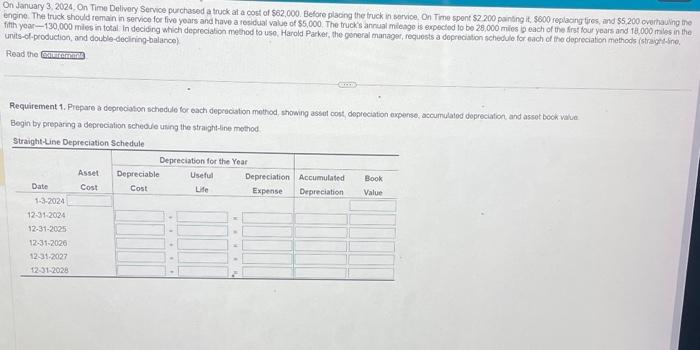

1. Prepare a depreciation schedule for each depreciation method, showing asset cost, depreciation expense, accumulated depreciation, and asset book value. 2. On Time prepares financial statements using the depreciation method that reports the highest net income in the early years of asset use. Consider the first year that On Time uses the truck. Identify the depreciation method that meets the company's objectives. Un January 3,2024, On Time Delivery Service purchesed a truck at a cost of $62,000. Before placing the truck in carvice. On Time spent $2,200 painting it, $600 repilacing tires, and $5,200 overhauling ine engine. Tha truck should remain in service for five yoars and have a tesidual value of $5,000. The trucks anrual mileage is expectod 10 be 28,000 milos b each of the frst four years ans te,000 males in the . fith yoon - 130,000 mies in total: In deciding which depreciabion method to uso, Harold Parker, the general managar, requests a depreciation schedule for each of ine deprecation methods (strayght-ine. units-of-production, and double-deciring-balance) Read the Requirement 1. Prepare a deprecison icthodule for each deprecistion mothod, showing assot cost dopreciaton axpense, accumulatod doprecation and assot book value. Begin by preparng a deprociation scheove using the straight-line method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts