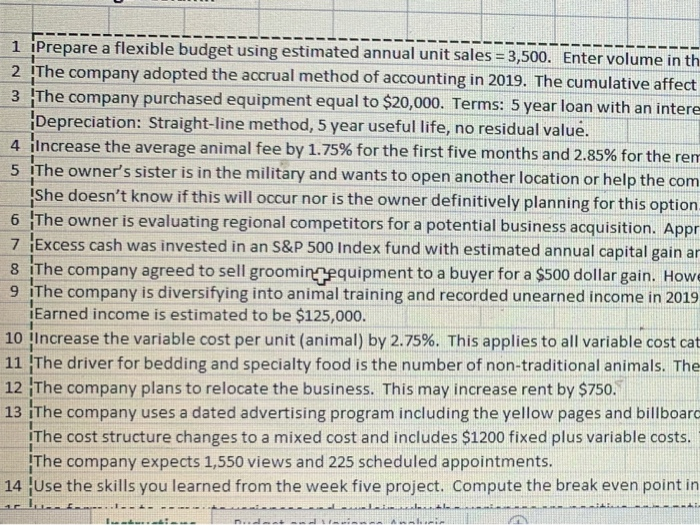

Question: 1 Prepare a flexible budget using estimated annual unit sales = 3,500. Enter volume in th 2 The company adopted the accrual method of accounting

1 Prepare a flexible budget using estimated annual unit sales = 3,500. Enter volume in th 2 The company adopted the accrual method of accounting in 2019. The cumulative affect 3 The company purchased equipment equal to $20,000. Terms: 5 year loan with an intere Depreciation: Straight-line method, 5 year useful life, no residual value. 4 Increase the average animal fee by 1.75% for the first five months and 2.85% for the rem 5 The owner's sister is in the military and wants to open another location or help the com she doesn't know if this will occur nor is the owner definitively planning for this option 6 The owner is evaluating regional competitors for a potential business acquisition. Appr 7 Excess cash was invested in an S&P 500 Index fund with estimated annual capital gain ar 8 'The company agreed to sell groomingequipment to a buyer for a $500 dollar gain. Howe 9 The company is diversifying into animal training and recorded unearned income in 2019 Earned income is estimated to be $125,000. 10 Increase the variable cost per unit (animal) by 2.75%. This applies to all variable cost cat 11 The driver for bedding and specialty food is the number of non-traditional animals. The 12 The company plans to relocate the business. This may increase rent by $750. 13 The company uses a dated advertising program including the yellow pages and billboard The cost structure changes to a mixed cost and includes $1200 fixed plus variable costs. The company expects 1,550 views and 225 scheduled appointments. 14 Use the skills you learned from the week five project. Compute the break even point in Lee AL Ali 1 Prepare a flexible budget using estimated annual unit sales = 3,500. Enter volume in th 2 The company adopted the accrual method of accounting in 2019. The cumulative affect 3 The company purchased equipment equal to $20,000. Terms: 5 year loan with an intere Depreciation: Straight-line method, 5 year useful life, no residual value. 4 Increase the average animal fee by 1.75% for the first five months and 2.85% for the rem 5 The owner's sister is in the military and wants to open another location or help the com she doesn't know if this will occur nor is the owner definitively planning for this option 6 The owner is evaluating regional competitors for a potential business acquisition. Appr 7 Excess cash was invested in an S&P 500 Index fund with estimated annual capital gain ar 8 'The company agreed to sell groomingequipment to a buyer for a $500 dollar gain. Howe 9 The company is diversifying into animal training and recorded unearned income in 2019 Earned income is estimated to be $125,000. 10 Increase the variable cost per unit (animal) by 2.75%. This applies to all variable cost cat 11 The driver for bedding and specialty food is the number of non-traditional animals. The 12 The company plans to relocate the business. This may increase rent by $750. 13 The company uses a dated advertising program including the yellow pages and billboard The cost structure changes to a mixed cost and includes $1200 fixed plus variable costs. The company expects 1,550 views and 225 scheduled appointments. 14 Use the skills you learned from the week five project. Compute the break even point in Lee AL Ali

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts