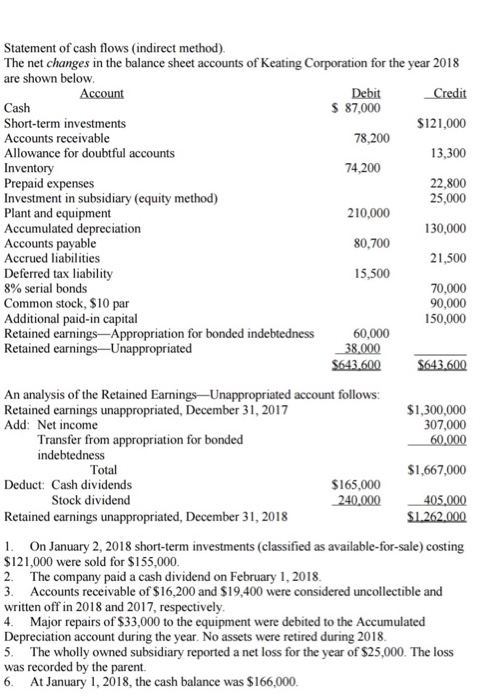

Question: 1) Prepare a statement of cash flows (indirect method) for the year ended December 31, 2018. Keating Construction has no securities which are classified as

Statement of cash flows (indirect method) The net changes in the balance sheet accounts of Keating Corporation for the year 2018 are shown below Debit S 87,000 Credit Account Cash Short-term investments Accounts receivable Allowance for doubtful accounts Inventory Prepaid expenses Investment in subsidiary (equity method) Plant and equipment Accumulated depreciation Accounts payable Accrued liabilities Deferred tax liability 8% serial bonds Common stock, $10 par Additional paid-in capital Retained earnings-Appropriation for bonded indebtedness Retained earnings-Unappropriated $121,000 78200 13.300 74,200 22,800 25,000 210,000 80,700 15,500 130,000 21,500 70,000 90,000 150,000 60,000 643.600 S643.600 An analysis of the Retained Earnings -Unappropriated account follows: Retained earnings unappropriated, December 31, 2017 Add: Net income $1,300,000 307,000 Transfer from appropriation for bonded indebtedness Total $1,667,000 S165,000 Deduct: Cash dividends Stock dividend Retained earnings unappropriated, December 31, 2018 1262,000 1. On January 2, 2018 short-term investments (classified as available-for-sale) costing $121,000 were sold for $155,000 2. The company paid a cash dividend on February 1, 2018. 3. Accounts receivable of $16,200 and $19,400 were considered uncollectible and written off in 2018 and 2017, respectively 4. Major repairs of $33,000 to the equipment were debited to the Accumulated Depreciation account during the year. No assets were retired during 2018 5. The wholly owned subsidiary reported a net loss for the year of $25,000. The loss was recorded by the parent 6. At January 1, 2018, the cash balance was $166,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts