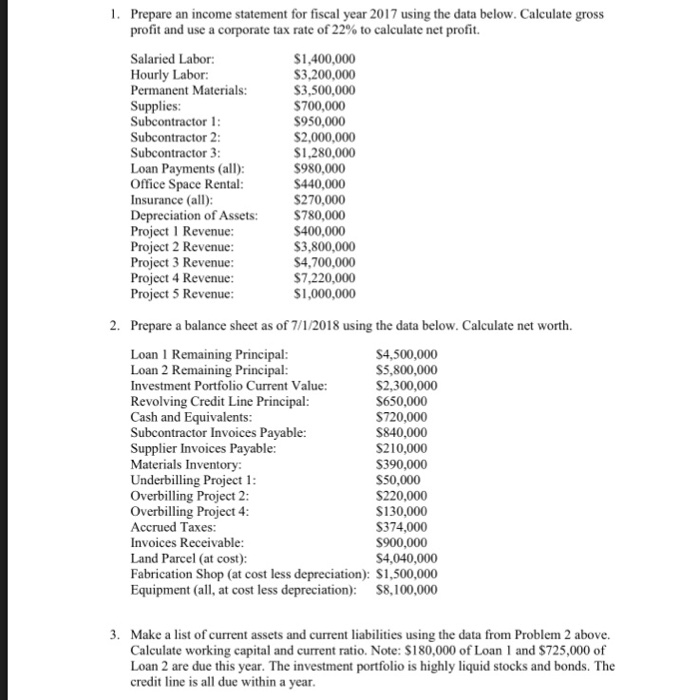

Question: 1. Prepare an income statement for fiscal year 2017 using the data below. Calculate gross profit and use a corporate tax rate of 22% to

1. Prepare an income statement for fiscal year 2017 using the data below. Calculate gross profit and use a corporate tax rate of 22% to calculate net profit. Salaried Labor: Hourly Labor Permanent Materials: Supplies: Subcontractor 1: Subcontractor 2 Subcontractor 3 Loan Payments (all) Office Space Rental Insurance (all) Depreciation of Assets $780,000 Project 1 Revenue: Project 2 Revenue Project 3 Revenue Project 4 Revenue Project 5 Revenue $1,400,000 $3,200,000 $3,500,000 $700,000 $950,000 $2,000,000 S1,280,000 $980,000 $440,000 $270,000 $400,000 S3,800,000 $4.700,000 $7,220,000 $1,000,000 2. Prepare a balance sheet as of 7/1/2018 using the data below. Calculate net worth. Loan 1 Remaining Principal Loan 2 Remaining Principal: Investment Portfolio Current Value: Revolving Credit Line Principal Cash and Equivalents: Subcontractor Invoices Payable: Supplier Invoices Payable: Materials Inventory Underbilling Project 1 Overbilling Project2 Overbilling Project 4 Accrued Taxes: Invoices Receivable: Land Parcel (at cost): Fabrication Shop (at cost less depreciation): $1,500,000 Equipment (all, at cost less depreciation): S8,100,000 S4,500,000 S5,800,000 S2,300,000 S650,000 $720,000 S840,000 S210,000 S390,000 S50,000 $220,000 S130,000 S374,000 $900,000 $4,040,000 3. Make a list of current assets and current liabilities using the data from Problem 2 above. Calculate working capital and current ratio. Note: $180,000 of Loan 1 and $725,000 of Loan 2 are due this year. The investment portfolio is highly liquid stocks and bonds. The credit line is all due within a year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts