Question: 1. Prepare general journal entries to record the preceding transactions. 2. Post to the general ledger accounts. 3. Prepare a year-end trial balance on a

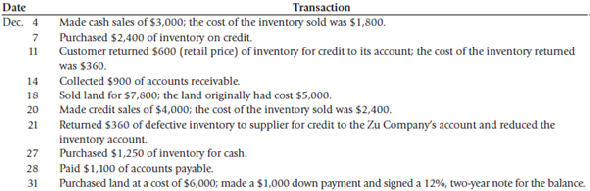

1. Prepare general journal entries to record the preceding transactions.

2. Post to the general ledger accounts.

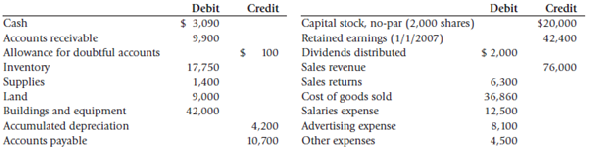

3. Prepare a year-end trial balance on a worksheet and complete the worksheet using the following information: (a) accrued salaries at year-end total $1,200; (b) for simplicity, the building and equipment are being depreciated using the straight-line method over an estimated life of 20 years with no residual value; (c) supplies on hand at the end of the year total $630; (d) bad debts expense for the year totals $830; and (e) the income tax rate is 30%; income taxes are payable in the first quarter of 2008.

4. Prepare the companys financial statements for 2007.

5. Prepare the 2007 (a) adjusting and (b) closing entries in the general journal.

Date Transaction Dec. 4 Made cash sales of $3,000; the cost of the inventory sold was $1,800. 7 Purchased $2,400 of inventory on credit. 11 Customer returned $600 (retail price) of inventory for credit to its acccunt; the cost of the inventory returned was $360. 14 Collected $900 of accounts receivable. 18 Sold land for $7,800; the land originally had cost $5,000. 20 Made credit sales of $4,000; the cost of the inventory sold was $2,400. 21 Returned $360 of defective inventory to supplier for credit to the Zu Company's account and reduced the inventory account. 27 Purchased $1,250 of inventory for cash 28 Paid $1,100 of accounts payable. 31 Purchased land at a cost of $6,000; made a $1,000 down payment and signed a 12%, two-year note for the balance. Date Transaction Dec. 4 Made cash sales of $3,000; the cost of the inventory sold was $1,800. 7 Purchased $2,400 of inventory on credit. 11 Customer returned $600 (retail price) of inventory for credit to its acccunt; the cost of the inventory returned was $360. 14 Collected $900 of accounts receivable. 18 Sold land for $7,800; the land originally had cost $5,000. 20 Made credit sales of $4,000; the cost of the inventory sold was $2,400. 21 Returned $360 of defective inventory to supplier for credit to the Zu Company's account and reduced the inventory account. 27 Purchased $1,250 of inventory for cash 28 Paid $1,100 of accounts payable. 31 Purchased land at a cost of $6,000; made a $1,000 down payment and signed a 12%, two-year note for the balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts