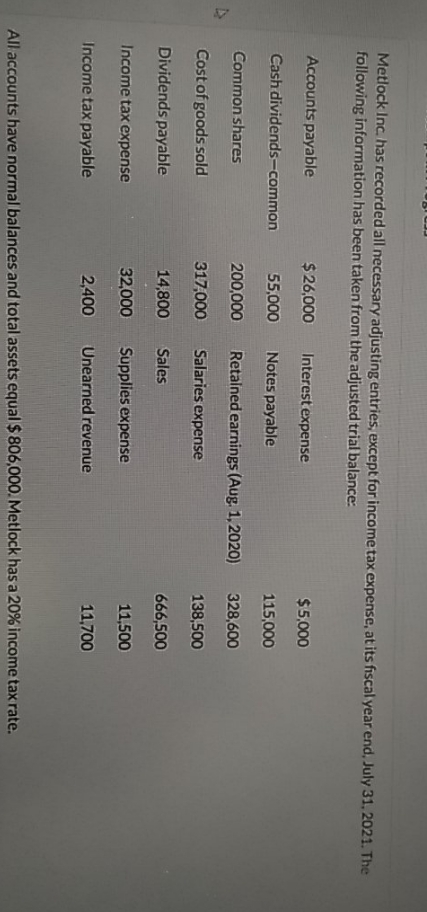

Question: 1. prepare income statement 2. prepare journal entry to record income tax expense. Metlock Inc. has recorded all necessary adjusting entries, except for income tax

1. prepare income statement 2. prepare journal entry to record income tax expense.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock