Question: 1. Prepare the adjusting journal entry on December 31, 2011, for the following independent situations. a. The allowance for doubtful accounts has a $700 adjustment.

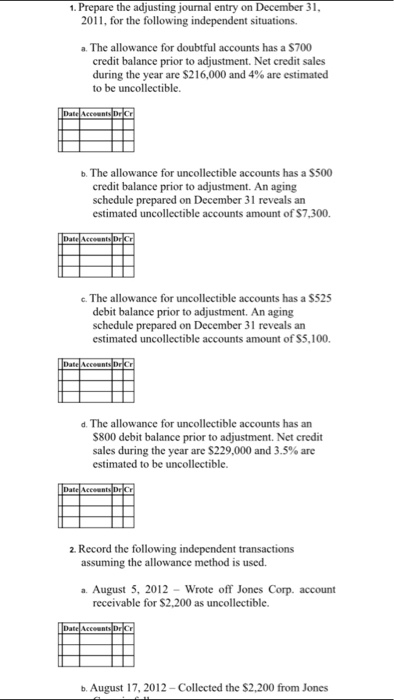

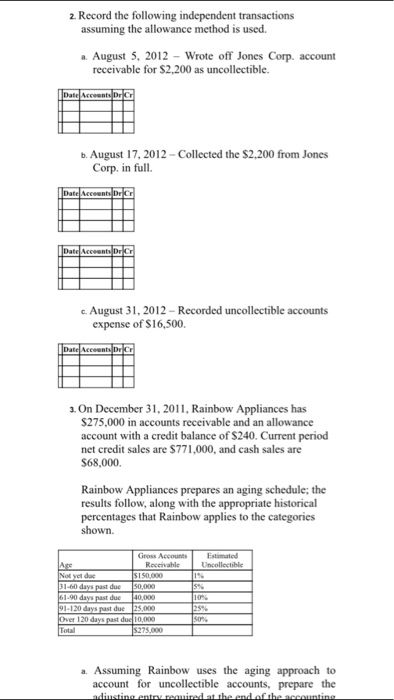

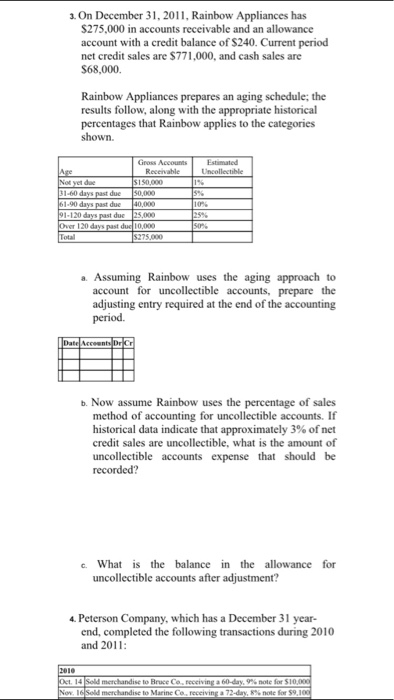

1. Prepare the adjusting journal entry on December 31, 2011, for the following independent situations. a. The allowance for doubtful accounts has a $700 adjustment. Net credit sales credit balance prior to during the year are $216,000 and 4% are estimated to be uncollectible. b. The allowance for uncollectible accounts has a S500 credit balance prior to adjustment. An aging schedule prepared on December 31 reveals an estimated uncollectible accounts amount of S7,300. c. The allowance for uncollectible accounts has a $525 debit balance prior to adjustment. An aging schedule prepared on December 31 reveals an estimated uncollectible accounts amount of S5,100. d. The allowance for uncollectible accounts has an $800 debit balance prior to adjustment. Net credit sales during the year are $229,000 and 3.5% are estimated to be uncollectible 2. Record the following independent transactions assuming the allowance method is used. a. August 5, 2012 Wrote off Jones Corp. account receivable for $2,200 as uncollectible. b. August 17, 2012-Collected the $2,200 from Jones

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts