Question: 1. Prepare the depreciation schedule for the machines using double decline method over 4 years from useful life. where A company purchased machines for BD

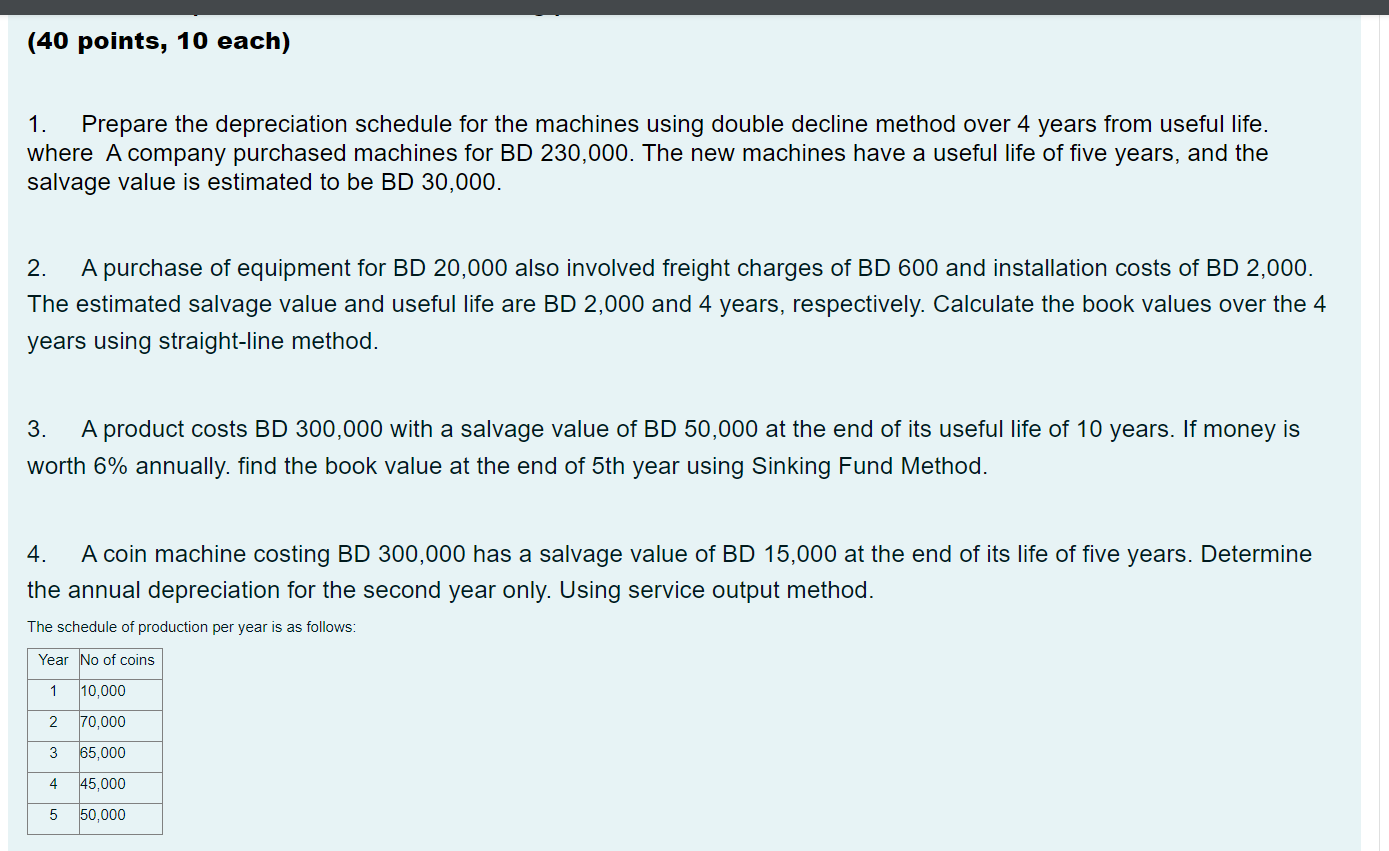

1. Prepare the depreciation schedule for the machines using double decline method over 4 years from useful life. where A company purchased machines for BD 230,000. The new machines have a useful life of five years, and the salvage value is estimated to be BD30,000. 2. A purchase of equipment for BD 20,000 also involved freight charges of BD600 and installation costs of BD2,000. The estimated salvage value and useful life are BD 2,000 and 4 years, respectively. Calculate the book values over the 4 years using straight-line method. 3. A product costs BD300,000 with a salvage value of BD50,000 at the end of its useful life of 10 years. If money is worth 6% annually. find the book value at the end of 5th year using Sinking Fund Method. 4. A coin machine costing BD300,000 has a salvage value of BD15,000 at the end of its life of five years. Determine the annual depreciation for the second year only. Using service output method. The schedule of production per year is as follows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts