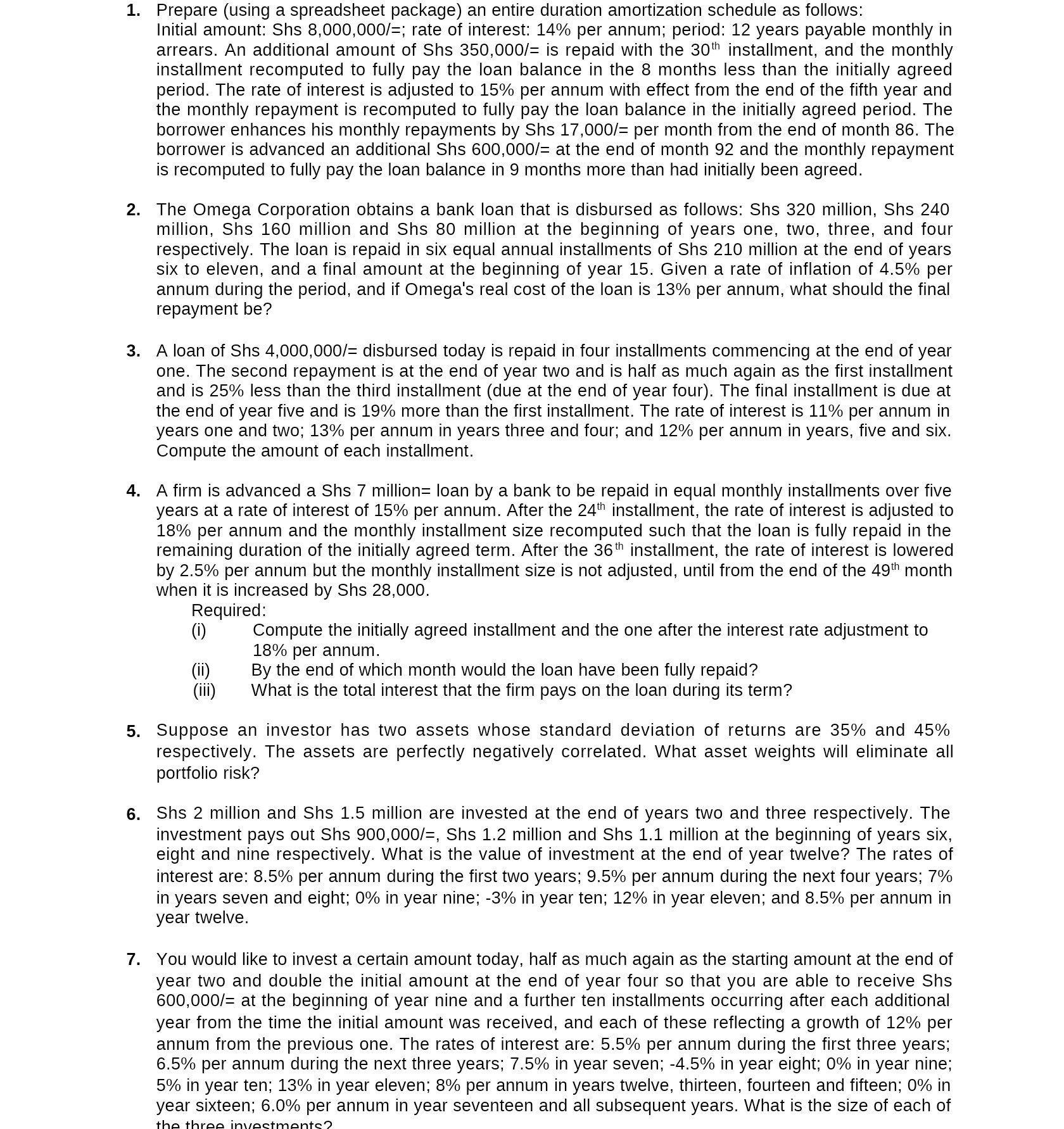

Question: 1. Prepare (using a spreadsheet package) an entire duration amortization schedule as follows: Initial amount: Shs 8,000,000]: rate of interest: 14% per annum; period: 12

1. Prepare (using a spreadsheet package) an entire duration amortization schedule as follows: Initial amount: Shs 8,000,000]: rate of interest: 14% per annum; period: 12 years payable monthly in arrears. An additional amount of Shs 350,000/= is repaid with the 30''1 installment, and the monthly installment recomputed to fully pay the loan balance in the 8 months less than the initially agreed period. The rate of interest is adjusted to 15% per annum with effect from the end of the fifth year and the monthly repayment is recomputed to fully pay the loan balance in the initially agreed period. The borrower enhances his monthly repayments by Shs 17,000]: per month from the end of month 86. The borrower is advanced an additional Shs 600,000]: at the end of month 92 and the monthly repayment is recomputed to fully pay the loan balance in 9 months more than had initially been agreed. 2. The Omega Corporation obtains a bank loan that is disbursed as follows: Shs 320 million, Shs 240 million, Shs 160 million and Shs 80 million at the beginning of years one, two, three, and four respectively. The loan is repaid in six equal annual installments of Shs 210 million at the end of years six to eleven, and a final amount at the beginning of year 15. Given a rate of inflation of 4.5% per annum during the period, and if Omega's real cost of the loan is 13% per annum, what should the final repayment be? 3. A loan of Shs 4,000,000]: disbursed today is repaid in four installments commencing at the end of year one. The second repayment is at the end of year two and is half as much again as the first installment and is 25% less than the third installment (due at the end of year four). The final installment is due at the end of year five and is 19% more than the first installment. The rate of interest is 11% per annum in years one and two; 13% per annum in years three and four; and 12% per annum in years, five and six. Compute the amount of each installment. 4. A firm is advanced a Shs 7 million: loan by a bank to be repaid in equal monthly installments over five years at a rate of interest of 15% per annum. After the 24th installment, the rate of interest is adjusted to 18% per annum and the monthly installment size recomputed such that the loan is fully repaid in the remaining duration of the initially agreed term. After the 36'\" installment, the rate of interest is lowered by 2.5% per annum but the monthly installment size is not adjusted, until from the end of the 49\"\" month when it is increased by Shs 28,000. Required: (i) Compute the initially agreed installment and the one after the interest rate adjustment to 18% per annum. (ii) By the end of which month would the loan have been fully repaid? (iii) What is the total interest that the firm pays on the loan during its term? 5. Suppose an investor has two assets whose standard deviation of returns are 35% and 45% respectively. The assets are perfectly negatively correlated. What asset weights will eliminate all portfolio risk? 6. Shs 2 million and Shs 1.5 million are invested at the end of years two and three respectively. The investment pays out Shs 900,000]; Shs 1.2 million and Shs 1.1 million at the beginning of years six, eight and nine respectively. What is the value of investment at the end of year twelve? The rates of interest are: 8.5% per annum during the first two years; 9.5% per annum during the next four years; 7% in years seven and eight; 0% in year nine; -3% in year ten; 12% in year eleven; and 8.5% per annum in year twelve. 7. You would like to invest a certain amount today, half as much again as the starting amount at the end of year two and double the initial amount at the end of year tour so that you are able to receive Shs 600,000]: at the beginning of year nine and a further ten installments occurring after each additional year from the time the initial amount was received, and each of these reflecting a growth of 12% per annum from the previous one. The rates of interest are: 5.5% per annum during the first three years; 6.5% per annum during the next three years; 7.5% in year seven; -4.5% in year eight; 0% in year nine; 5% in year ten; 13% in year eleven; 8% per annum in years twelve, thirteen, fourteen and fifteen; 0% in year sixteen; 6.0% per annum in year seventeen and all subsequent years. What is the size of each of the thrnn inuncfmnnfe')