Question: 1. Present Value and Multiple Cash Flows [LO1J Wainright Co. has identified an investment project with the following cash flows. If the discount rate is

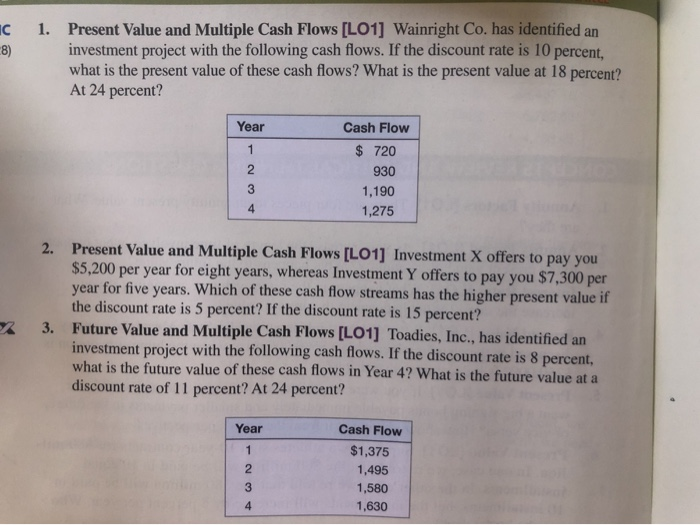

1. Present Value and Multiple Cash Flows [LO1J Wainright Co. has identified an investment project with the following cash flows. If the discount rate is 10 percent. what is the present value of these cash flows? What is the present value at 18 percent? At 24 percent? Year AWN- Cash Flow $ 720 930 1,190 1,275 2 2. Present Value and Multiple Cash Flows [LO1] Investment X offers to pay you $5,200 per year for eight years, whereas Investment Y offers to pay you $7,300 per year for five years. Which of these cash flow streams has the higher present value if the discount rate is 5 percent? If the discount rate is 15 percent? 3. Future Value and Multiple Cash Flows [LO1] Toadies, Inc., has identified an investment project with the following cash flows. If the discount rate is 8 percent. what is the future value of these cash flows in Year 4? What is the future value at a discount rate of 11 percent? At 24 percent? Year Cash Flow $1,375 1,495 1,580 1,630

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts