Question: 1. Pretend that you are saving up for a down payment on a car or house. Pretend that we get an inheritance of $3,000 so

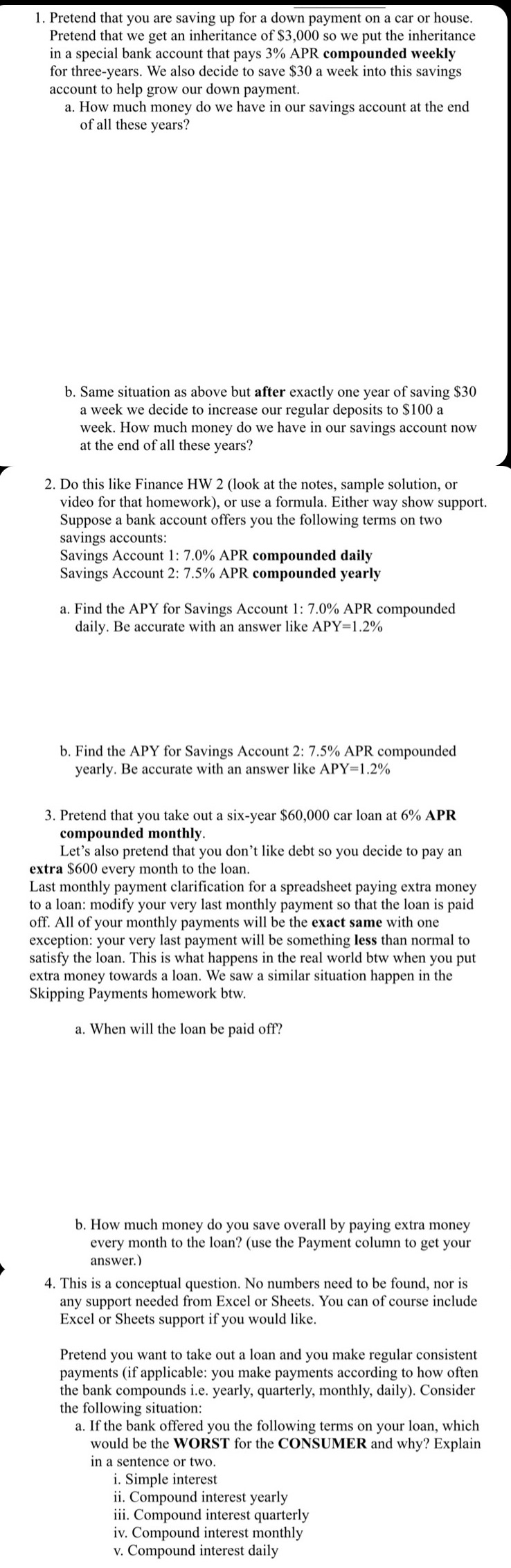

1. Pretend that you are saving up for a down payment on a car or house. Pretend that we get an inheritance of $3,000 so we put the inheritance in a special bank account that pays 3% APR compounded weekly for three-years. We also decide to save $30 a week into this savings account to help grow our down payment. a. How much money do we have in our savings account at the end of all these years? b. Same situation as above but after exactly one year of saving $30 a week we decide to increase our regular deposits to $100 a week. How much money do we have in our savings account now at the end of all these years? [ . Do this like Finance HW 2 (look at the notes, sample solution, or video for that homework), or use a formula. Either way show support. Suppose a bank account offers you the following terms on two savings accounts: Savings Account 1: 7.0% APR compounded daily Savings Account 2: 7.5% APR compounded yearly a. Find the APY for Savings Account 1: 7.0% APR compounded daily. Be accurate with an answer like APY=1.2% b. Find the APY for Savings Account 2: 7.5% APR compounded yearly. Be accurate with an answer like APY=1.2% 2 . Pretend that you take out a six-year $60,000 car loan at 6% APR compounded monthly. Let's also pretend that you don't like debt so you decide to pay an extra $600 every month to the loan. Last monthly payment clarification for a spreadsheet paying extra money to a loan: modify your very last monthly payment so that the loan is paid off. All of your monthly payments will be the exact same with one exception: your very last payment will be something less than normal to satisfy the loan. This is what happens in the real world btw when you put extra money towards a loan. We saw a similar situation happen in the Skipping Payments homework btw. a. When will the loan be paid off? b. How much money do you save overall by paying extra money every month to the loan? (use the Payment column to get your answer.) 4. This is a conceptual question. No numbers need to be found, nor is any support needed from Excel or Sheets. You can of course include Excel or Sheets support if you would like. Pretend you want to take out a loan and you make regular consistent payments (if applicable: you make payments according to how often the bank compounds i.e. yearly, quarterly, monthly, daily). Consider the following situation: a. If the bank offered you the following terms on your loan, which would be the WORST for the CONSUMER and why? Explain in a sentence or two. i. Simple interest il. Compound interest yearly i Compound interest quarterly iv. Compound interest monthly v. Compound interest daily

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts