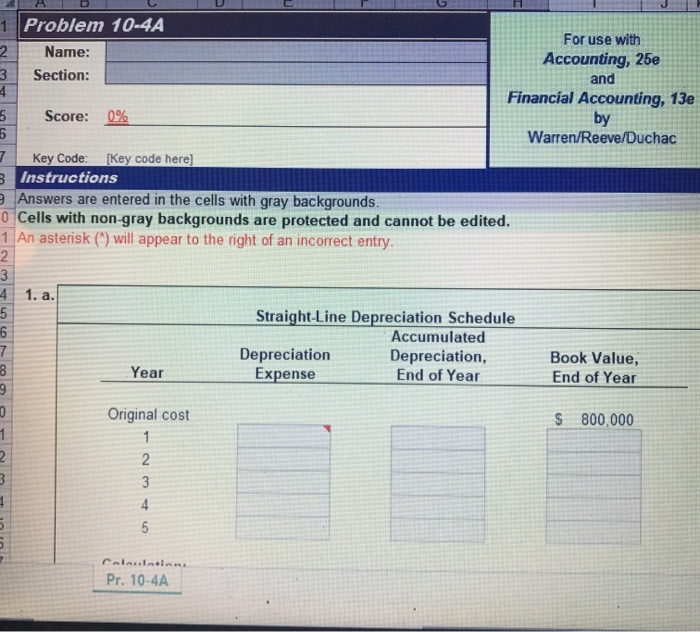

Question: 1 Problem 10-4A Name: Section: For use with Accounting, 25e and Financial Accounting, 13e Score: 0% by UU Warren/Reeve/Duchac Key Code: [Key code here) 3

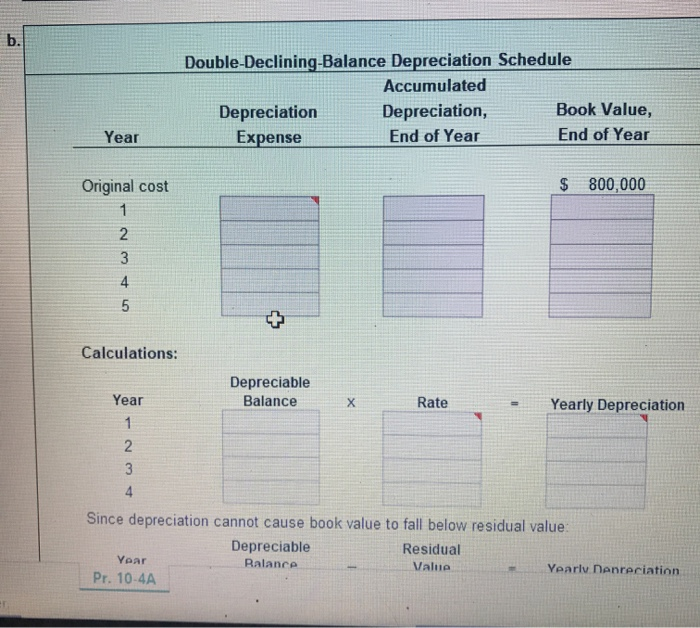

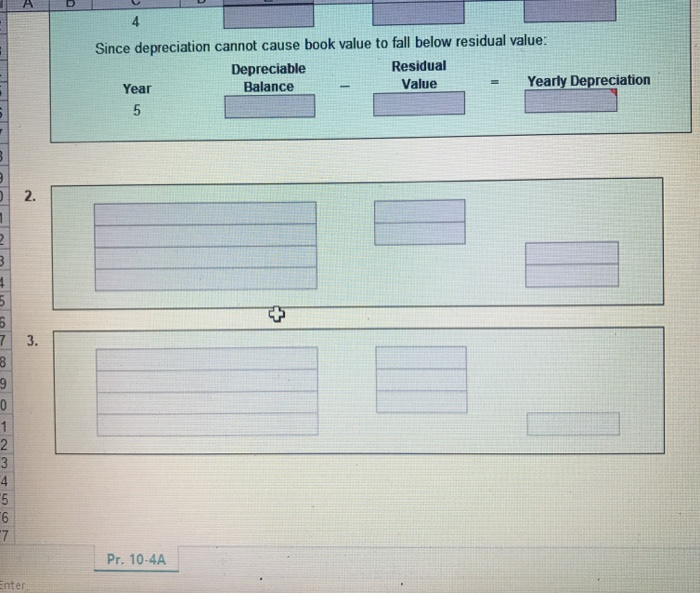

1 Problem 10-4A Name: Section: For use with Accounting, 25e and Financial Accounting, 13e Score: 0% by UU Warren/Reeve/Duchac Key Code: [Key code here) 3 Instructions Answers are entered in the cells with gray backgrounds. 0 Cells with non-gray backgrounds are protected and cannot be edited. 1 An asterisk (*) will appear to the right of an incorrect entry. LLO Straight-Line Depreciation Schedule Accumulated Depreciation Depreciation, Expense End of Year Book Value, End of Year Year Original cost $ 800,000 - OWN Calarilaren Pr. 10-4A Double-Declining-Balance Depreciation Schedule Accumulated Depreciation Depreciation, Book Value, Expense End of Year End of Year Year Original cost $ 800,000 AWN Calculations: Year Depreciable Balance Rate Yearly Depreciation Since depreciation cannot cause book value to fall below residual value: Depreciable Residual Year Balance Value Yearly Danreciation Pr. 10-4A Since depreciation cannot cause book value to fall below residual value: Depreciable Residual Year Balance Value Yearly Depreciation US NUU UW Pr. 10-4A inter 1 Problem 10-4A Name: Section: For use with Accounting, 25e and Financial Accounting, 13e Score: 0% by UU Warren/Reeve/Duchac Key Code: [Key code here) 3 Instructions Answers are entered in the cells with gray backgrounds. 0 Cells with non-gray backgrounds are protected and cannot be edited. 1 An asterisk (*) will appear to the right of an incorrect entry. LLO Straight-Line Depreciation Schedule Accumulated Depreciation Depreciation, Expense End of Year Book Value, End of Year Year Original cost $ 800,000 - OWN Calarilaren Pr. 10-4A Double-Declining-Balance Depreciation Schedule Accumulated Depreciation Depreciation, Book Value, Expense End of Year End of Year Year Original cost $ 800,000 AWN Calculations: Year Depreciable Balance Rate Yearly Depreciation Since depreciation cannot cause book value to fall below residual value: Depreciable Residual Year Balance Value Yearly Danreciation Pr. 10-4A Since depreciation cannot cause book value to fall below residual value: Depreciable Residual Year Balance Value Yearly Depreciation US NUU UW Pr. 10-4A inter

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts