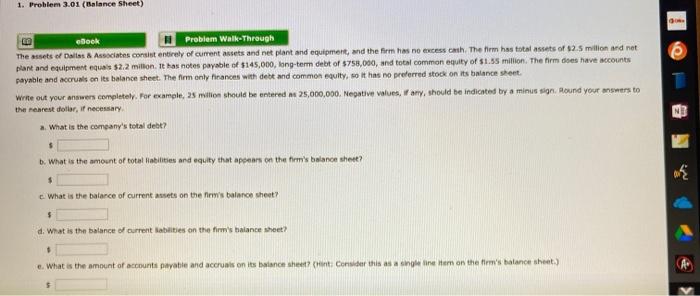

Question: 1. Problem 3.01 (Balance Sheet) ebook Problem Walk-Through The assets of Dallas & Associates consist entirely of current assets and net plant and equipment, and

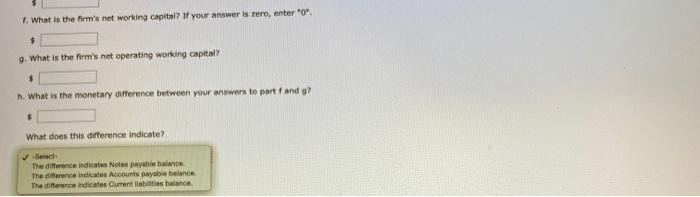

1. Problem 3.01 (Balance Sheet) ebook Problem Walk-Through The assets of Dallas & Associates consist entirely of current assets and net plant and equipment, and the firm has no excess enth. The firm has total assets of $2.5 million and net plant and equipment quas $2.2 millon. It has notes payable of $145,000, long-term debt of $750,000, and total common equity of 51.35 million. The firm does have accounts payable and accruals on its balance sheet. The firm only finances with debt and common equity, so it has no preferred stock on its balance sheet write out your answers completely. For example, 25 million should be entered me 25,000,000. Nepative values, Wany, should be indicated by a minus sign. Round your answers to the nearest dollar, if necessary a What is the company's total debt? NE b. What is the amount or total abilities and equity that appears on the balance sheet? $ What is the balance of current mets on the firew's balance sheet? $ d. What is the balance of current abilities on the firm's balance sheet? e. What is the amount of accounts payable and accruals on its balance sheet in Consider this as a neem on the firm's balance sheet) 1. What is the firm's net working capital? If your answer is rero, entero 9. What is the firm's net operating working capital? $ h. What is the monetary difference between your answers to part fand g? $ What does this difference indicate? The difference indicates Notes payable balance The difference indicates Accounts payable balance The difference indicates Current les balance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts