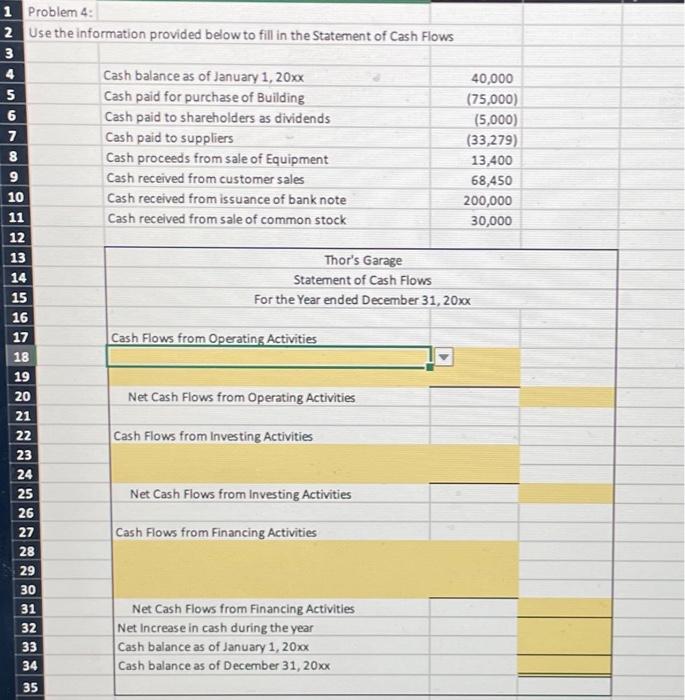

Question: 1 Problem 4: 2 Use the information provided below to fill in the Statement of Cash Flows 3 4 Cash paid for purchase of Building

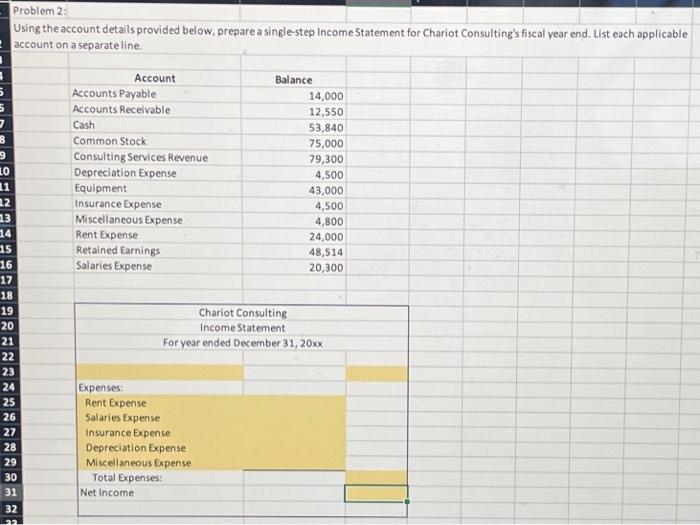

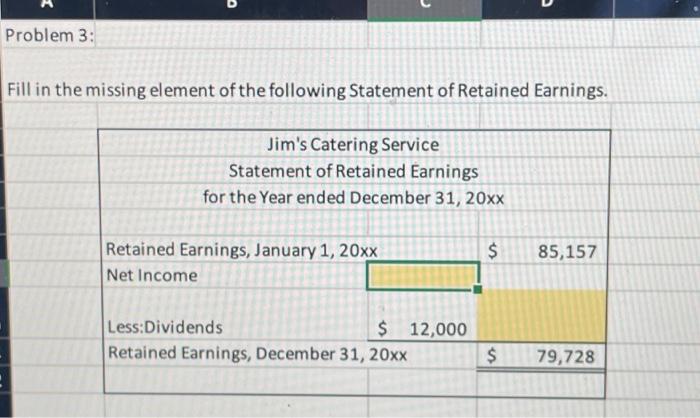

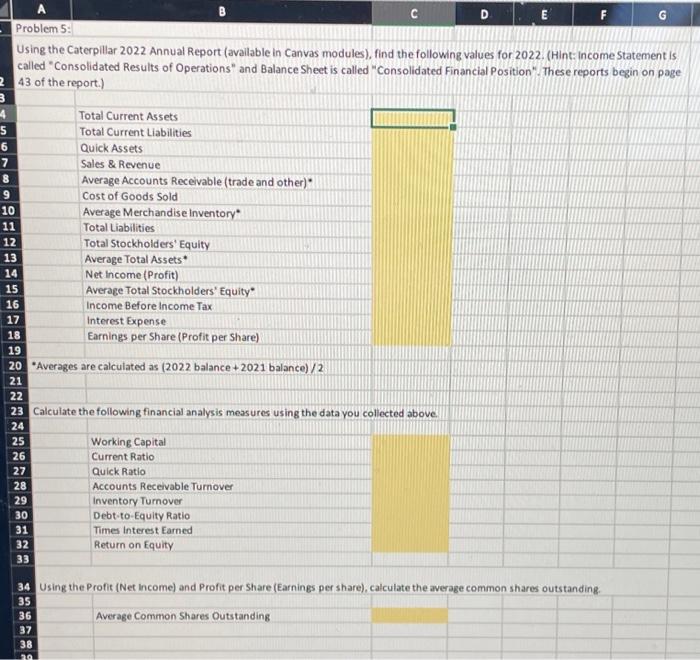

1 Problem 4: 2 Use the information provided below to fill in the Statement of Cash Flows 3 4 Cash paid for purchase of Building Cash paid to shareholders as dividends Cash paid to suppliers Cash proceeds from sale of Equipment Cash received from customer sales Cash received from issuance of bank note Cash received from sale of common stock 40,000 (75,000) (5,000) (33,279) 13,400 68,450 200,000 30,000 Thor's Garage Statement of Cash Flows For the Year ended December 31,20xx Net Cash Flows from Operating Activities Cash Flows from Investing Activities Net Cash Flows from Investing Activities Cash Flows from Financing Activities Net Cash Flows from Financing Activities Net Increase in cash during the year Cash balance as of January 1,20xx Cash balance as of December 31, 20xo Using th accoun! Fill in the missing element of the following Statement of Retained Earnings. Problem 5: B Using the Caterpillar 2022 Annual Report (avaliable in Canvas modules), find the following values for 2022 . (Hint: income Statement is called "Consolidated Results of Operations" and Balance Sheet is called "Consolidated Financial Position". These reports begin on page 43 of the report.) Total Current Assets Total Current Liabilities Quick Assets Sales \& Revenue Average Accounts Receivable (trade and other) * Cost of Goods Sold Average Merchandise inventory* Total Liabilities Total Stockholders' Equity Average Total Assets * Net income (Profit) Average Total Stockholders' Equity* Income Before income Tax Interest Expense Earnings per Share (Profit per Share) -Averages are calculated as (2022 balance +2021 balance )/2 21 22 23 Calculate the following financial analysis measures using the data you collected above. 28 Accounts Receivable Turnover 29 inventory Turnover 30. Debt-to-Equity Ratio 31 Times interest Earned 32 Return on Equity 33 34 Using the Profit (Net income) and Profit per Share (Earnings per share), calculate the average common shares outstanding. 35 36 Average Common Shares Outstanding

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts