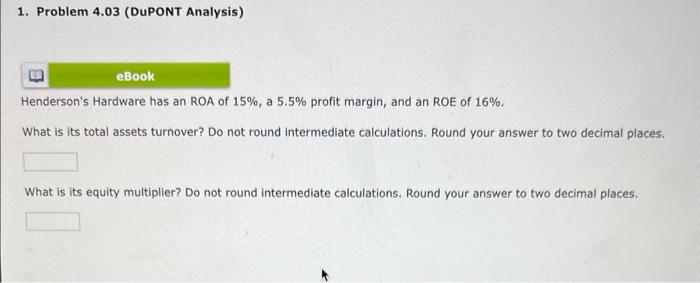

Question: 1. Problem 4.03 (DuPONT Analysis) Henderson's Hardware has an ROA of 15%, a 5.5% profit margin, and an ROE of 16%. What is its total

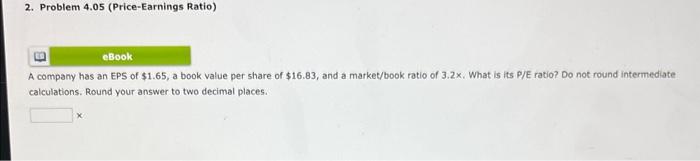

1. Problem 4.03 (DuPONT Analysis) Henderson's Hardware has an ROA of 15%, a 5.5% profit margin, and an ROE of 16%. What is its total assets turnover? Do not round intermediate calculations. Round your answer to two decimal places. What is its equity multiplier? Do not round intermediate calculations. Round your answer to two decimal places. A company has an EPS of $1.65, a book value per share of $16.83, and a market/book ratio of 3.2x. What is its P/E ratio? Do not round intermediate calculations. Round your answer to two decimal places

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock