Question: 1. Problem 7.01 (Bond Valuation) B eBook Problem Walk-Through Madsen Motors's bonds have 25 years remaining to maturity. Interest is paid annually, they have

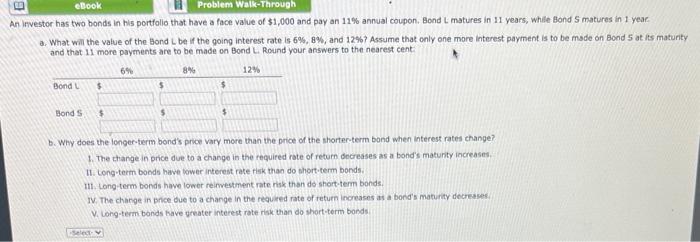

1. Problem 7.01 (Bond Valuation) B eBook Problem Walk-Through Madsen Motors's bonds have 25 years remaining to maturity. Interest is paid annually, they have a $1,000 par value, the coupon interest rate is 7%, and the yield to maturity is 0% What is the bond's current market price? Round your answer to the nearest cent $ eBook Problem Walk-Through An Investor has two bonds in his portfolio that have a face value of $1,000 and pay an 11% annual coupon. Bond L matures in 11 years, while Bond S matures in 1 year. a. What will the value of the Bond L be if the going interest rate is 6%, 8%, and 12 % 7 Assume that only one more interest payment is to be made on Bond S at its maturity and that 11 more payments are to be made on Bond L. Round your answers to the nearest cent 6% 8% 12% Bond L $ $ $ Bond S $ $ $ b. Why does the longer-term bond's price vary more than the price of the shorter-term bond when interest rates change? 1. The change in price due to a change in the required rate of return decreases as a bond's maturity increases. 11. Long-term bonds have lower interest rate risk than do short-term bonds. 111. Long-term bonds have lower reinvestment rate risk than do short-term bonds. Select IV. The change in price due to a change in the required rate of return increases as a bond's maturity decreases. V. Long-term bonds have greater interest rate risk than do short-term bonds.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts