Question: 1. Problem Statement: Acrotren Electronies is considering purchasing a water filtration system to assist in circuit board manufacturing. The system costs $32,000. It has an

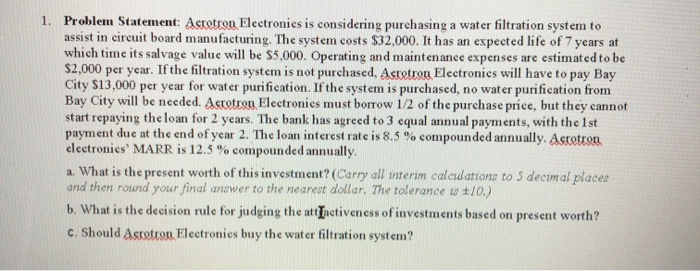

1. Problem Statement: Acrotren Electronies is considering purchasing a water filtration system to assist in circuit board manufacturing. The system costs $32,000. It has an expected life of 7 years at which time its salvage value will be $5,000. Operating and maintenance expenses are estimated to be $2,000 per year. If the filtration system is not purchased, Acrotron Electronics will have to pay Bay City $13,000 per year for water purification. If the system is purchased, no water purification from Bay City will be needed. Accotron Electronics must borrow 1/2 of the purchase price, but they cannot start repaying the loan for 2 years. The bank has agreed to 3 equal annual payments, with the 1st payment due at the end of year 2. The loan interest rate is 8.5 % compounded annually. Acretron electronics' MARR is 12.5% compounded annually. a. What is the present worth of this investment? (Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is $10.) b. What is the decision rule for judging the attactiveness of investments based on present worth? c. Should Ascotron Electronics buy the water filtration system

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts