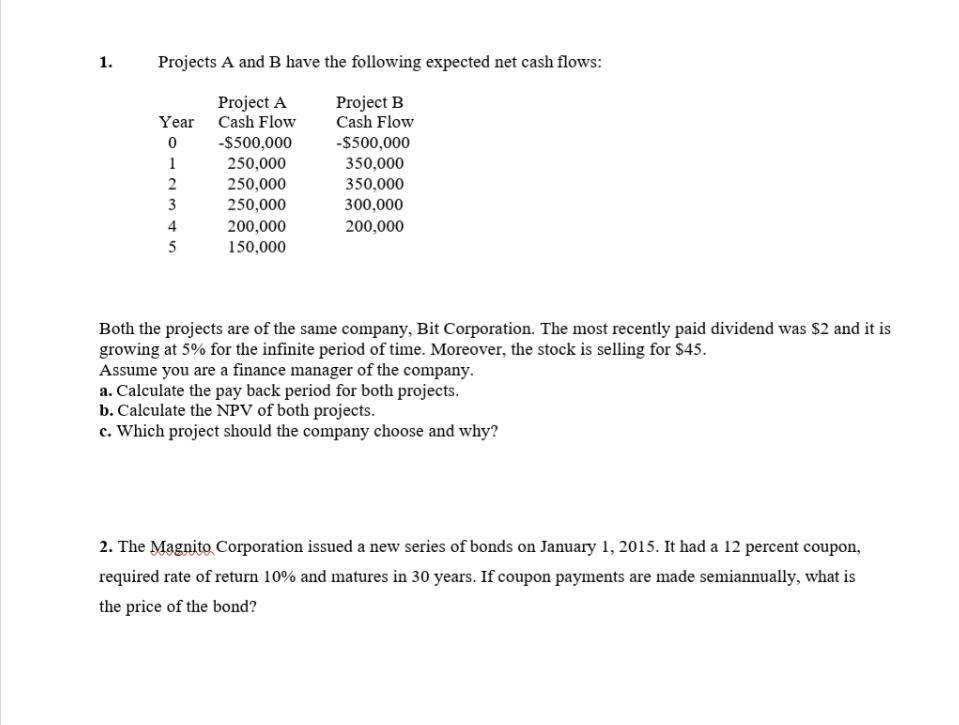

Question: 1. Projects A and B have the following expected net cash flows: Project B Project A Cash Flow Cash Flow Year 0 1 2

1. Projects A and B have the following expected net cash flows: Project B Project A Cash Flow Cash Flow Year 0 1 2 3 345 4 -$500,000 250,000 250,000 250,000 200,000 150,000 -$500,000 350,000 350,000 300,000 200,000 Both the projects are of the same company, Bit Corporation. The most recently paid dividend was $2 and it is growing at 5% for the infinite period of time. Moreover, the stock is selling for $45. Assume you are a finance manager of the company. a. Calculate the pay back period for both projects. b. Calculate the NPV of both projects. c. Which project should the company choose and why? 2. The Magnito Corporation issued a new series of bonds on January 1, 2015. It had a 12 percent coupon, required rate of return 10% and matures in 30 years. If coupon payments are made semiannually, what is the price of the bond?

Step by Step Solution

3.46 Rating (156 Votes )

There are 3 Steps involved in it

1a Calculate the payback period for both projects For Project A Year 0 500000 Year 1 500000 250000 250000 Year 2 250000 250000 0 breakeven Payback Per... View full answer

Get step-by-step solutions from verified subject matter experts