Question: 1. Property distributed to a partner in a Non-liquidating Distribution with an adjusted Basis to the Partnership less than the Partner's basis in her Partnership

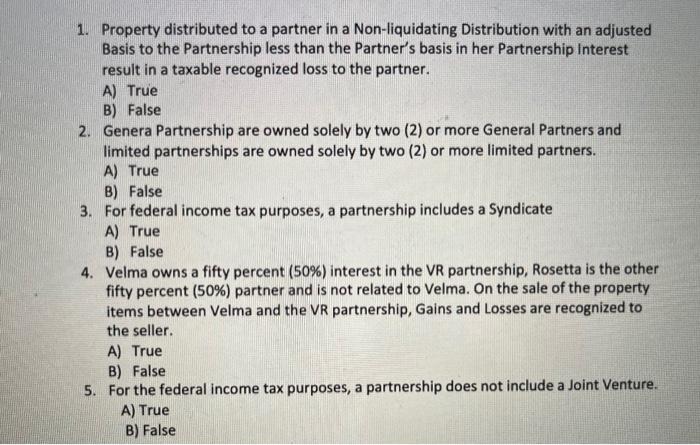

1. Property distributed to a partner in a Non-liquidating Distribution with an adjusted Basis to the Partnership less than the Partner's basis in her Partnership Interest result in a taxable recognized loss to the partner. A) True B) False 2. Genera Partnership are owned solely by two (2) or more General Partners and limited partnerships are owned solely by two (2) or more limited partners. A) True B) False 3. For federal income tax purposes, a partnership includes a Syndicate A) True B) False 4. Velma owns a fifty percent (50%) interest in the VR partnership, Rosetta is the other fifty percent (50%) partner and is not related to Velma. On the sale of the property items between Velma and the VR partnership, Gains and Losses are recognized to the seller. A) True B) False 5. For the federal income tax purposes, a partnership does not include a Joint Venture. A) True B) False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts