Question: (-), 1 pts D l Question 1 Deferred taxes should be presented on the balance sheet O as either noncurrent or current. O as reductions

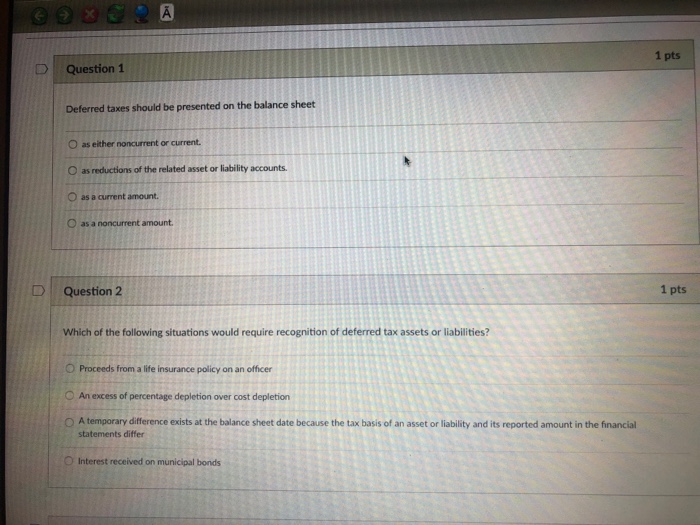

(-), 1 pts D l Question 1 Deferred taxes should be presented on the balance sheet O as either noncurrent or current. O as reductions of the related asset or liability accounts. O as a current amount. O as a noncurrent amount. D l Question 2 1 pts Which of the following situations would require recognition of deferred tax assets or liabilities? O Proceeds from a life insurance policy on an officer An excess of percentage depletion over cost depletion 0 A temporary difference exists at the balance sheet date because the tax basis of an asset or liability and its reported amount in the financial statements differ O Interest received on municipal bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts