Question: 1 pts D Question 28 Which statement regarding DURATION is false? For corporate bonds, duration can never exceed maturity Consider a simple interest loan and

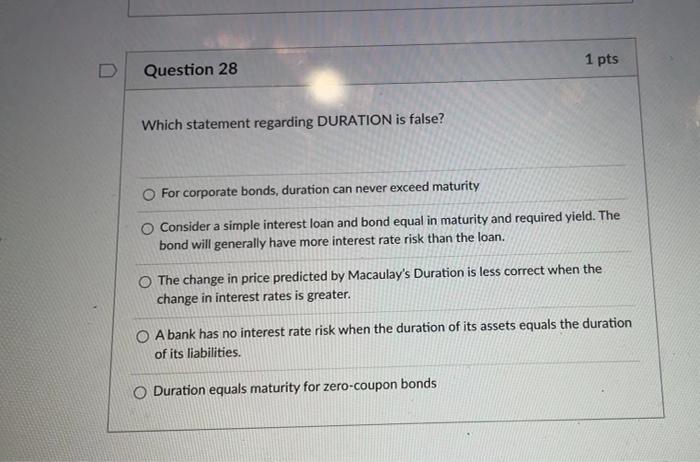

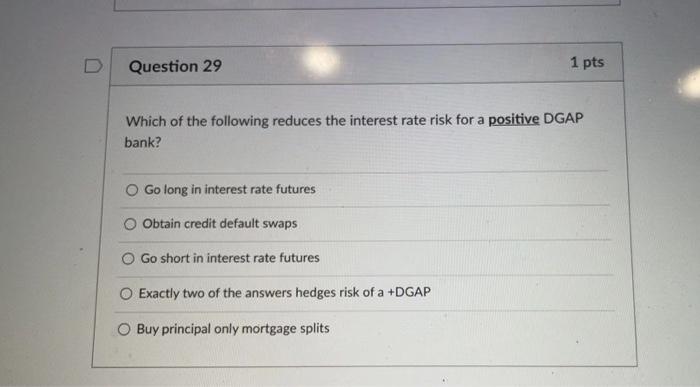

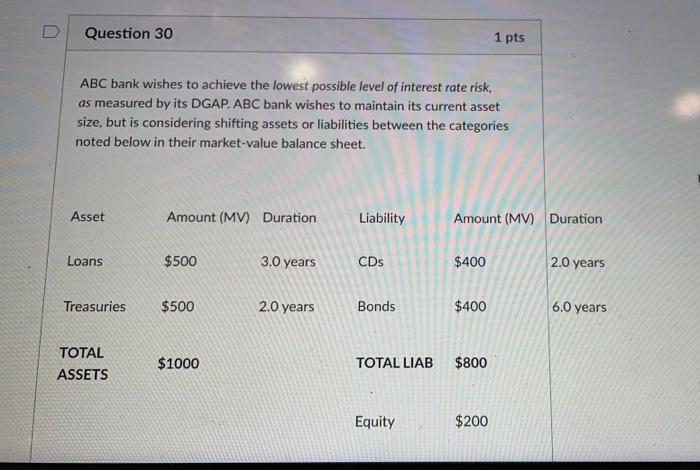

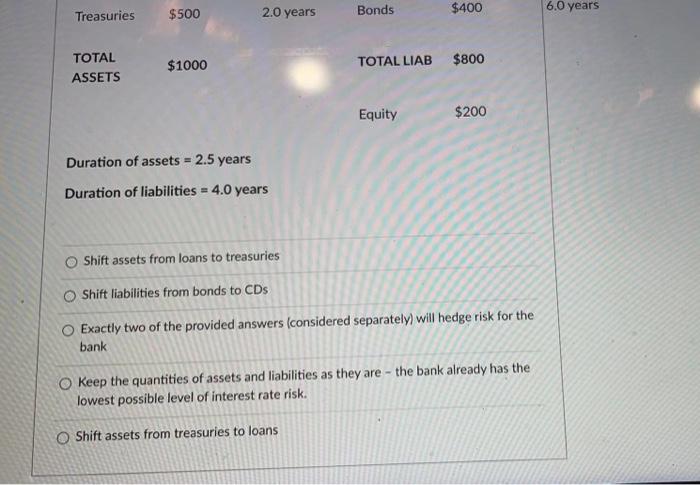

1 pts D Question 28 Which statement regarding DURATION is false? For corporate bonds, duration can never exceed maturity Consider a simple interest loan and bond equal in maturity and required yield. The bond will generally have more interest rate risk than the loan. The change in price predicted by Macaulay's Duration is less correct when the change in interest rates is greater. A bank has no interest rate risk when the duration of its assets equals the duration of its liabilities. Duration equals maturity for zero-coupon bonds Question 29 1 pts Which of the following reduces the interest rate risk for a positive DGAP bank? O Go long in interest rate futures Obtain credit default swaps O Go short in interest rate futures O Exactly two of the answers hedges risk of a +DGAP O Buy principal only mortgage splits Question 30 1 pts ABC bank wishes to achieve the lowest possible level of interest rate risk, as measured by its DGAP. ABC bank wishes to maintain its current asset size, but is considering shifting assets or liabilities between the categories noted below in their market value balance sheet. Asset Amount (MV) Duration Liability Amount (MV) Duration Loans $500 3.0 years CDs $400 2.0 years Treasuries $500 2.0 years Bonds $400 6.0 years TOTAL ASSETS $1000 TOTAL LIAB $800 Equity $200 $500 Treasuries Bonds 2.0 years $400 6.0 years TOTAL ASSETS $1000 TOTAL LIAB $800 Equity $200 Duration of assets = 2.5 years Duration of liabilities = 4.0 years Shift assets from loans to treasures O Shift liabilities from bonds to CDs Exactly two of the provided answers (considered separately) will hedge risk for the bank Keep the quantities of assets and liabilities as they are the bank already has the lowest possible level of interest rate risk. Shift assets from treasuries to loans

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts