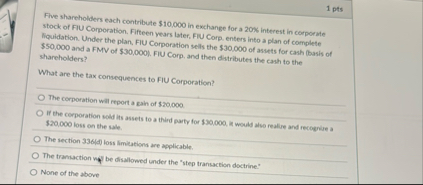

Question: 1 pts Five shareholders each contribute $ 1 0 , 0 0 0 in exchange for a 2 0 5 interest in corporste stock of

pts

Five shareholders each contribute $ in exchange for a interest in corporste stock of FIU Corporation. Fifteen years later, FIU Corp, enters into a plan of complete liquidation. Under the plan, FIU Corporation sells the $ of assets for cash lbasis of $ and a FMV of $ FIU Corp, and then distributes the cash to the shareholders?

What are Uhe tax consequences to FIU Corporation?

The corporation will report a Eain of $

If the corporation sold its assets to a thind partv for $ $ tors on the sale.

The section loss limitations are applicable.

The tramaction ny be disallowed under the "step transaction doctrine"

None of the above

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock