Question: 1 pts Forecast your additional funds needed based on the balance sheet below if your most recent annual sales was 9000, your projected sales growth

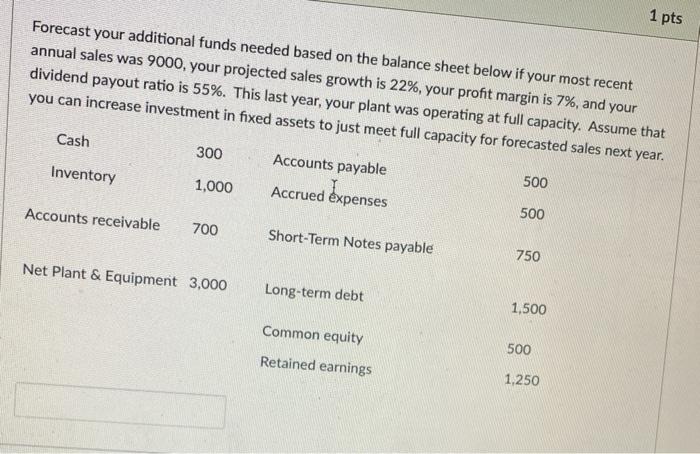

1 pts Forecast your additional funds needed based on the balance sheet below if your most recent annual sales was 9000, your projected sales growth is 22%, your profit margin is 7%, and your dividend payout ratio is 55%. This last year, your plant was operating at full capacity. Assume that you can increase investment in fixed assets to just meet full capacity for forecasted sales next year. Cash 300 Inventory Accounts payable Accrued expenses 1,000 500 Accounts receivable 500 700 Short-Term Notes payable 750 Net Plant & Equipment 3,000 Long-term debt 1,500 Common equity 500 Retained earnings 1,250

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts