Question: 1 pts One more assumption to make for this question. Now assume that just before issuance of the bonds by these two entities the Congress

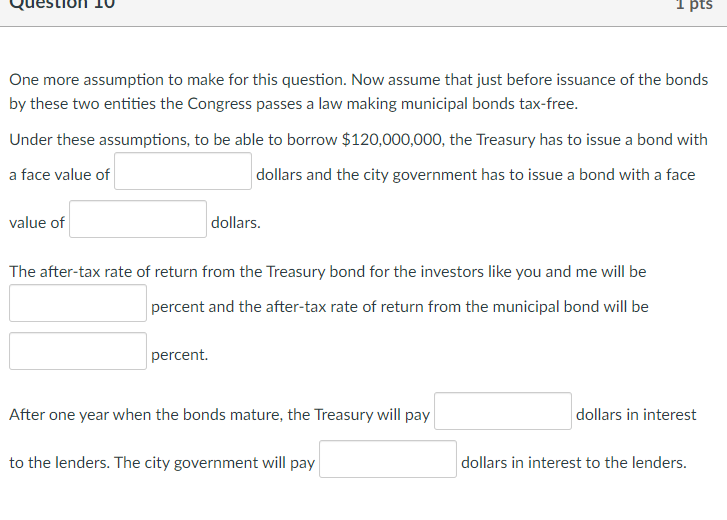

1 pts One more assumption to make for this question. Now assume that just before issuance of the bonds by these two entities the Congress passes a law making municipal bonds tax-free. Under these assumptions, to be able to borrow $120,000,000, the Treasury has to issue a bond with a face value of dollars and the city government has to issue a bond with a face value of dollars. The after-tax rate of return from the Treasury bond for the investors like you and me will be percent and the after-tax rate of return from the municipal bond will be percent. After one year when the bonds mature, the Treasury will pay dollars in interest to the lenders. The city government will pay dollars in interest to the lenders. 1 pts One more assumption to make for this question. Now assume that just before issuance of the bonds by these two entities the Congress passes a law making municipal bonds tax-free. Under these assumptions, to be able to borrow $120,000,000, the Treasury has to issue a bond with a face value of dollars and the city government has to issue a bond with a face value of dollars. The after-tax rate of return from the Treasury bond for the investors like you and me will be percent and the after-tax rate of return from the municipal bond will be percent. After one year when the bonds mature, the Treasury will pay dollars in interest to the lenders. The city government will pay dollars in interest to the lenders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts