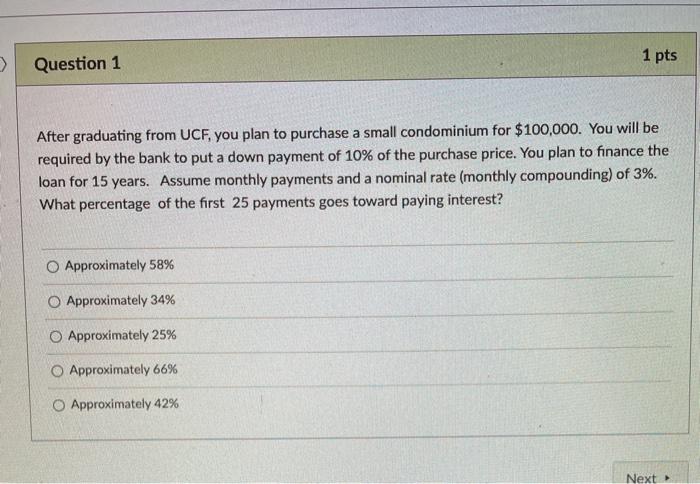

Question: 1 pts Question 1 After graduating from UCF, you plan to purchase a small condominium for $100,000. You will be required by the bank to

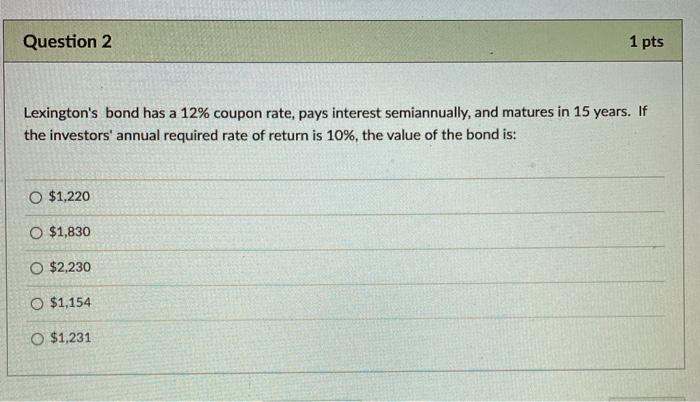

1 pts Question 1 After graduating from UCF, you plan to purchase a small condominium for $100,000. You will be required by the bank to put a down payment of 10% of the purchase price. You plan to finance the loan for 15 years. Assume monthly payments and a nominal rate (monthly compounding) of 3%. What percentage of the first 25 payments goes toward paying interest? O Approximately 58% O Approximately 34% O Approximately 25% O Approximately 66% Approximately 42% Next Question 2 1 pts Lexington's bond has a 12% coupon rate, pays interest semiannually, and matures in 15 years. If the investors' annual required rate of return is 10%, the value of the bond is: O $1,220 $1,830 O $2,230 $1,154 O $1,231

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts