Question: 1 pts Question 2 Genaro needs to capture a return of 24 percent for his one-year investment in a property. He believes that he can

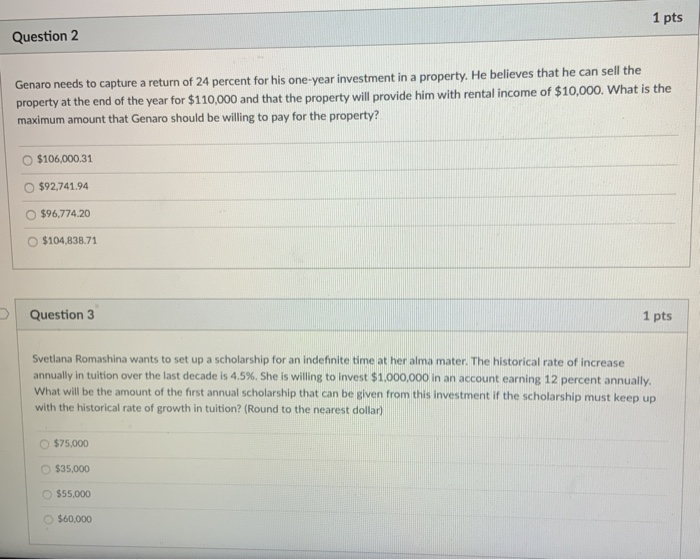

1 pts Question 2 Genaro needs to capture a return of 24 percent for his one-year investment in a property. He believes that he can sell the property at the end of the year for $110,000 and that the property will provide him with rental income of $10,000. What is the maximum amount that Genaro should be willing to pay for the property? $106,000.31 $92,741.94 $96,774.20 $104,838.71 Question 3 1 pts Svetlana Romashina wants to set up a scholarship for an indefinite time at her alma mater. The historical rate of increase annually in tuition over the last decade is 4.5%. She is willing to invest $1,000,000 in an account earning 12 percent annually. What will be the amount of the first annual scholarship that can be given from this investment if the scholarship must keep up with the historical rate of growth in tuition? (Round to the nearest dollar) $75,000 $35,000 $55,000 $60.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts