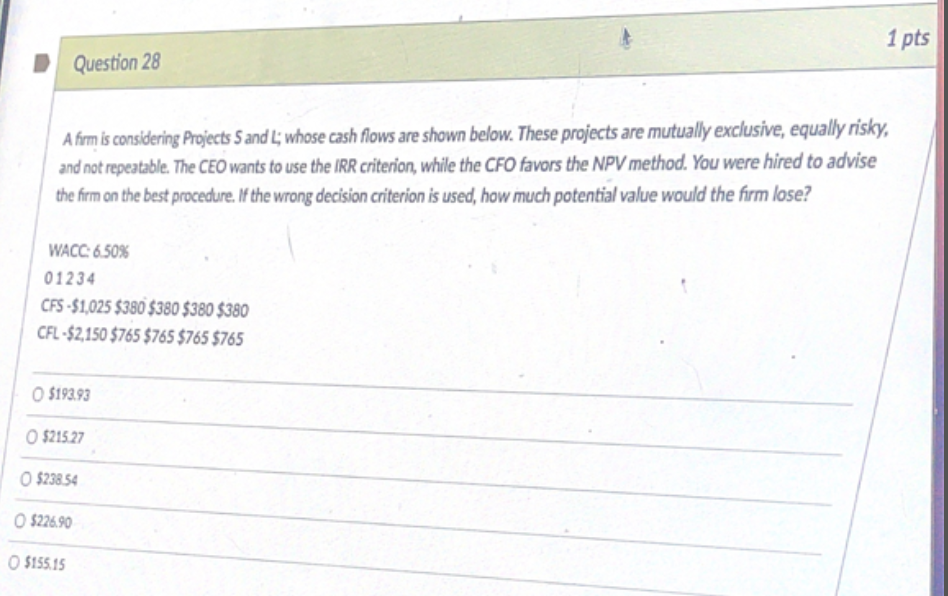

Question: 1 pts Question 28 A frm is considering Projects S and L; whose cash flows are shown below. These projects are mutually exclusive, equally risky,

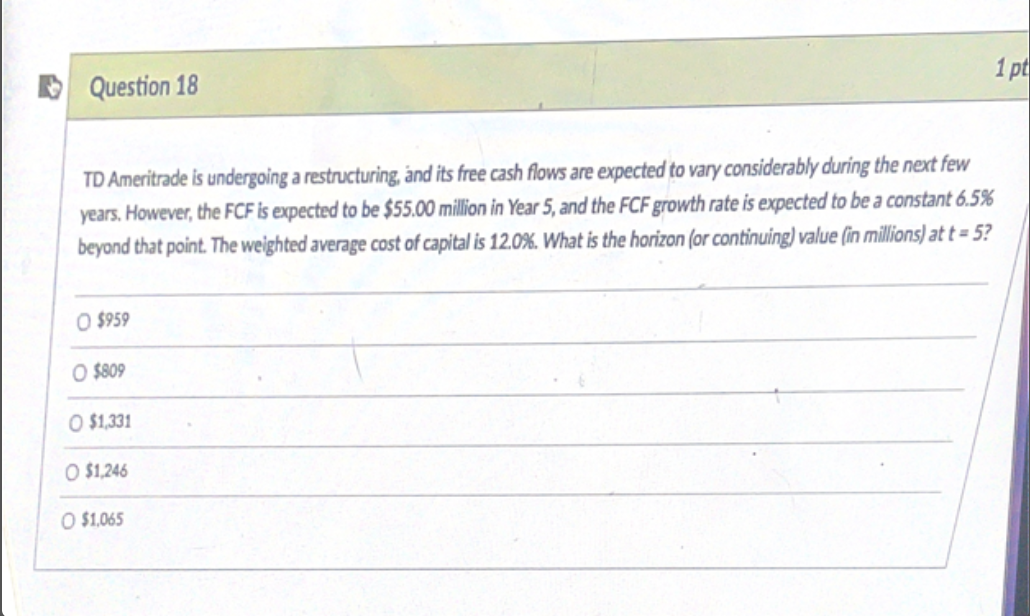

1 pts Question 28 A frm is considering Projects S and L; whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. The CEO wants to use the IRR criterion, while the CFO favors the NPV method. You were hired to advise the firm on the best procedure. If the wrong decision criterion is used, how much potential value would the firm lose? WACC 6.50% 01234 CFS -$1,025 $380 $380 $380 $380 CFL-$2,150 $765 $765 $765 $765 $193.93 O521527 O $238.54 $226.90 O $155.15 1 pt Question 18 TD Ameritrade is undergoing a restructuring, and its free cash flows are expected to vary considerably during the next few years. However, the FCF is expected to be $55.00 million in Year 5, and the FCF growth rate is expected to be a constant 6.5% beyond that point. The weighted average cost of capital is 12.0%. What is the horizon (or continuing) value (in Millions) at t= 5? O $959 O $809 O $1331 O $1,246 O $1,065

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts