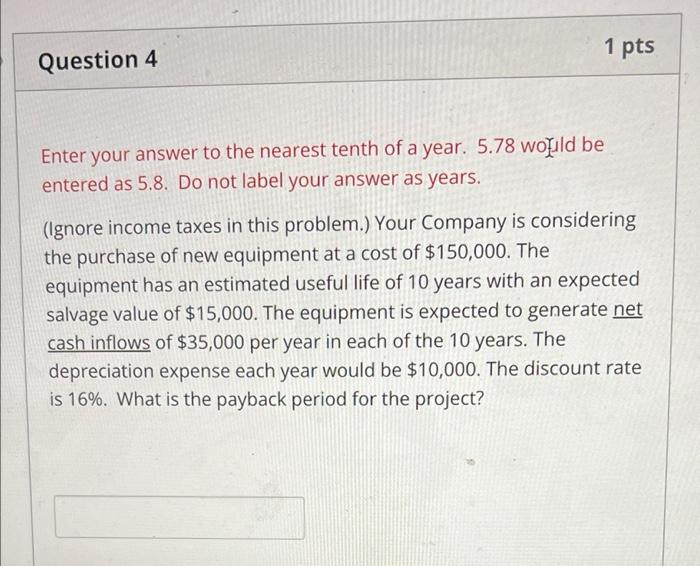

Question: 1 pts Question 4 Enter your answer to the nearest tenth of a year. 5.78 would be entered as 5.8. Do not label your answer

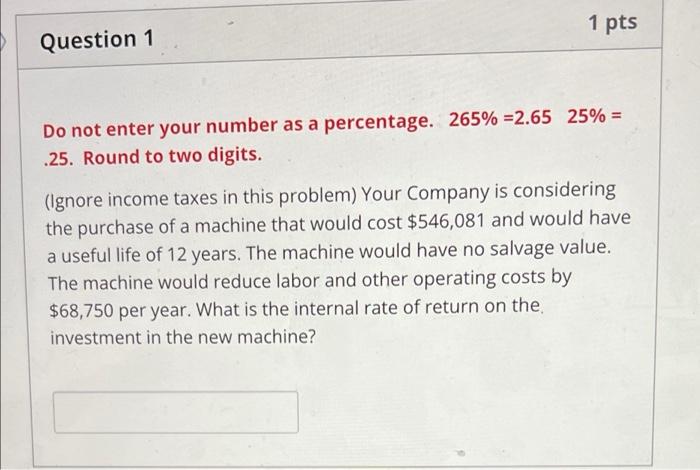

1 pts Question 4 Enter your answer to the nearest tenth of a year. 5.78 would be entered as 5.8. Do not label your answer as years. (Ignore income taxes in this problem.) Your Company is considering the purchase of new equipment at a cost of $150,000. The equipment has an estimated useful life of 10 years with an expected salvage value of $15,000. The equipment is expected to generate net cash inflows of $35,000 per year in each of the 10 years. The depreciation expense each year would be $10,000. The discount rate is 16%. What is the payback period for the project? 1 pts Question 1 Do not enter your number as a percentage. 265% = 2.65 25% = .25. Round to two digits. (Ignore income taxes in this problem) Your Company is considering the purchase of a machine that would cost $546,081 and would have a useful life of 12 years. The machine would have no salvage value. The machine would reduce labor and other operating costs by $68,750 per year. What is the internal rate of return on the investment in the new machine

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts