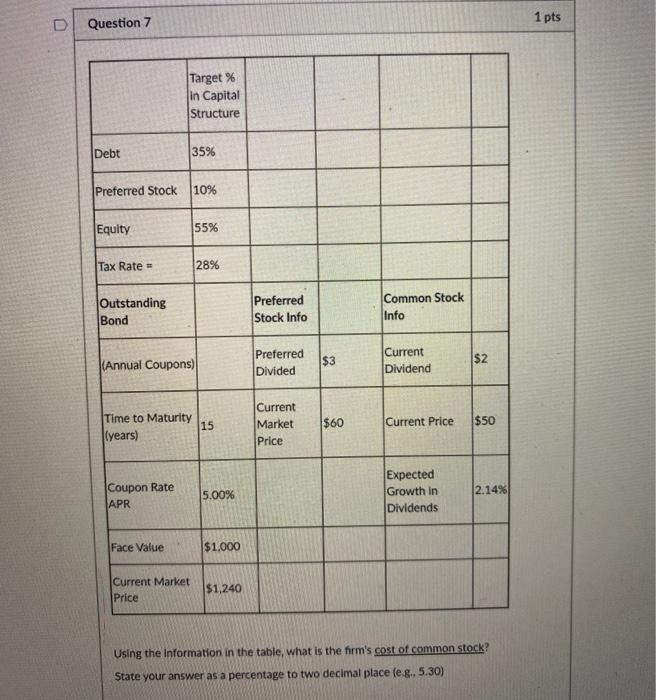

Question: 1 pts U Question 7 Target % in Capital Structure Debt 35% Preferred Stock 10% Equity 55% Tax Rate 28% Outstanding Bond Preferred Stock Info

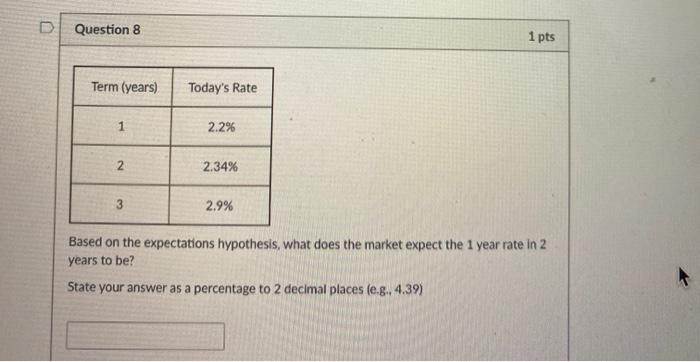

1 pts U Question 7 Target % in Capital Structure Debt 35% Preferred Stock 10% Equity 55% Tax Rate 28% Outstanding Bond Preferred Stock Info Common Stock Info Preferred Divided (Annual Coupons) $3 Current Dividend $2 Time to Maturity 15 (years) Current Market Price $60 Current Price $50 Coupon Rate APR 5.00% Expected Growth in Dividends 2.14% Face Value $1,000 Current Market Price $1,240 Using the Information in the table, what is the firm's cost of common stock? State your answer as a percentage to two decimal place le g., 5.30) Dl Question 8 1 pts Term (years) Today's Rate 1 2.2% 2. 2.34% 3 2.9% Based on the expectations hypothesis, what does the market expect the 1 year rate in 2 years to be? State your answer as a percentage to 2 decimal places (e.3.4.39)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts