Question: 1 pts Use for the next one question On September 15, 2020, Food Exporters USA, Inc. exported products to a New Zealand firm and expected

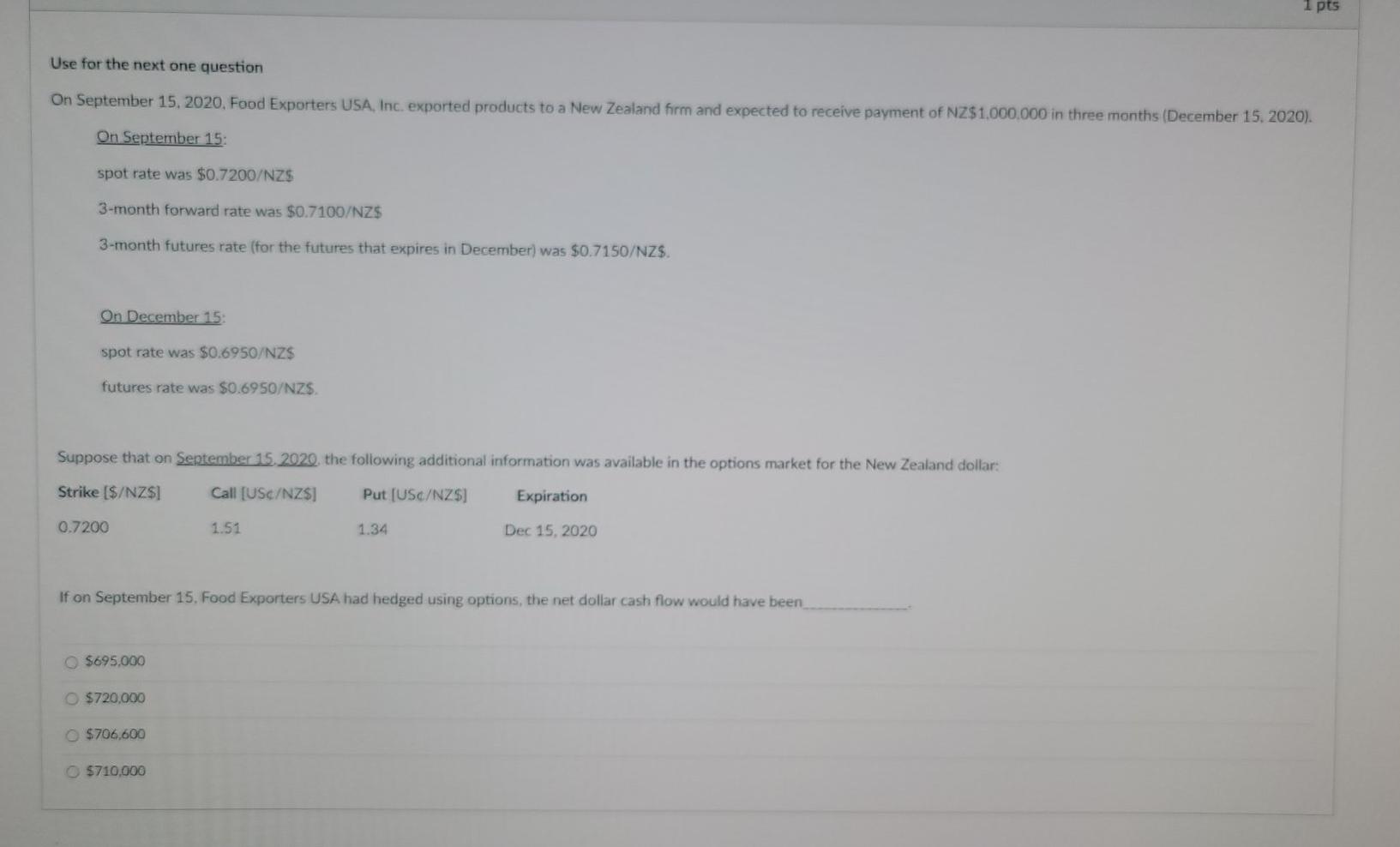

1 pts Use for the next one question On September 15, 2020, Food Exporters USA, Inc. exported products to a New Zealand firm and expected to receive payment of NZ$1.000.000 in three months (December 15, 2020). On September 15: spot rate was $0.7200/NZS 3-month forward rate was $0.7100/NZ$ 3-month futures rate (for the futures that expires in December) was $0.7150/NZS. On December 15 spot rate was $0.6950/NZS futures rate was $0.6950/NZS Suppose that on September 15, 2020, the following additional information was available in the options market for the New Zealand dollar: Strike ($/NZS Call [US/NZ$) Put (USC/NZ$) Expiration 0.7200 1.51 1.34 Dec 15, 2020 If on September 15, Food Exporters USA had hedged using options, the net dollar cash flow would have been $695,000 $720,000 $706,600 $710.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts