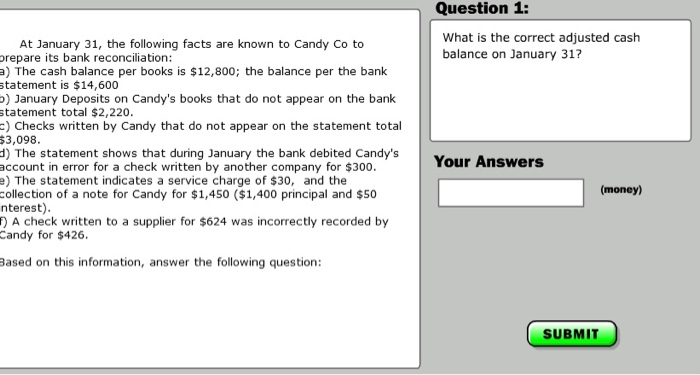

Question: 1 Q- multiple part Question 1: What is the correct adjusted cash balance on January 31? At January 31, the following facts are known to

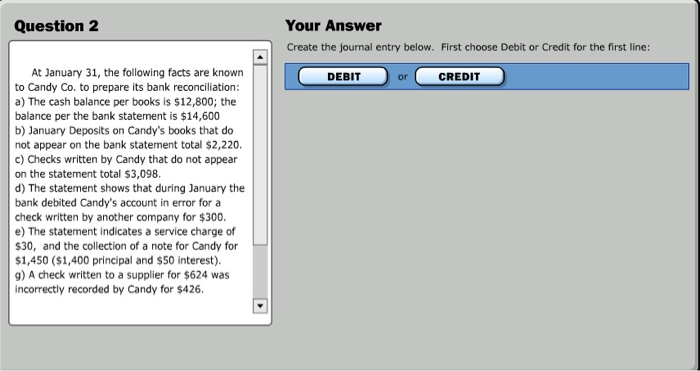

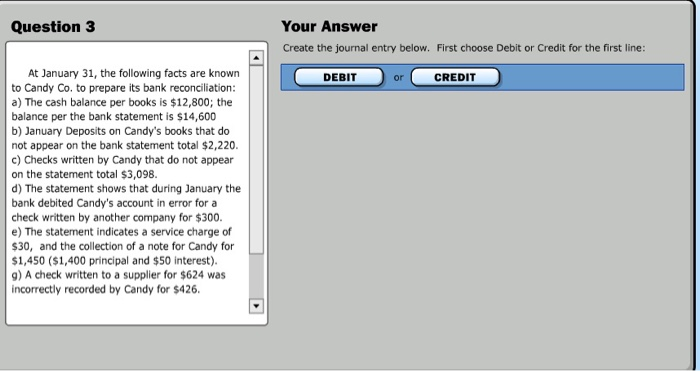

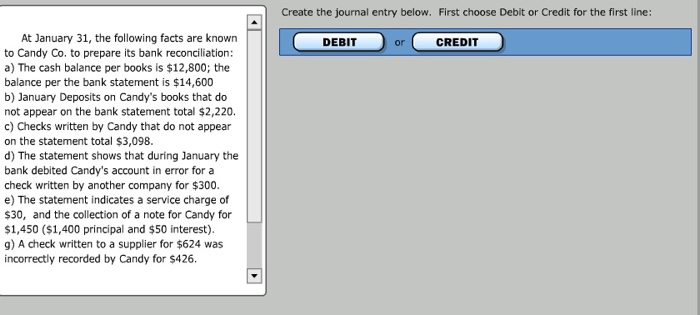

Question 1: What is the correct adjusted cash balance on January 31? At January 31, the following facts are known to Candy Co to prepare its bank reconciliation: a) The cash balance per books is $12,800; the balance per the bank statement is $14,600 5) January Deposits on Candy's books that do not appear on the bank statement total $2,220. :) Checks written by Candy that do not appear on the statement total Your Answers 1) The statement shows that during January the bank debited Candy's account in error for a check written by another company for $300. 2) The statement indicates a service charge of $30, and the collection of a note for Candy for $1,450 ($1,400 principal and $50 nterest). A check written to a supplier for $624 was incorrectly recorded by Based on this information, answer the following question: SUBMIT Question 2 Your Answer Create the journal entry below. First choose Debit or Credit for the first line: DEBIT or CREDIT At January 31, the following facts are known to Candy Co. to prepare its bank reconciliation: a) The cash balance per books is $12,800; the balance per the bank statement is $14,600 b) January Deposits on Candy's books that do not appear on the bank statement total $2,220. c) Checks written by Candy that do not appear on the statement total $3,098. d) The statement shows that during January the bank debited Candy's account in error for a check written by another company for $300. e) The statement indicates a service charge of $1,450 ($1,400 principal and $50 interest). 9) A check written to a supplier for $624 was incorrectly recorded by Candy for $426. Question 3 Your Answer Create the journal entry below. First choose Debit or Credit for the first line: DEBIT or CREDIT At January 31, the following facts are known to Candy Co. to prepare its bank reconciliation: a) The cash balance per books is $12,800; the balance per the bank statement is $14,600 b) January Deposits on Candy's books that do not appear on the bank statement total $2,220. c) Checks written by Candy that do not appear on the statement total $3,098 d) The statement shows that during January the bank debited Candy's account in error for a check written by another company for $300. e) The statement indicates a service charge of $30, and the collection of a note for Candy for $1,450 ($1,400 principal and $50 interest). 9) A check written to a supplier for $624 was incorrectly recorded by Candy for $426. Create the journal entry below. First choose Debit or Credit for the first line: DEBIT or CREDIT At January 31, the following facts are known to Candy Co. to prepare its bank reconciliation: a) The cash balance per books is $12,800; the not appear on the bank statement total $2,220. c) Checks written by Candy that do not appear on the statement total $3,098. d) The statement shows that during January the bank debited Candy's account in error for a e) The statement indicates a service charge of $30, and the collection of a note for Candy for $1,450 ($1,400 principal and $50 interest). g) A check written to a supplier for $624 was incorrectly recorded by Candy for $426

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts