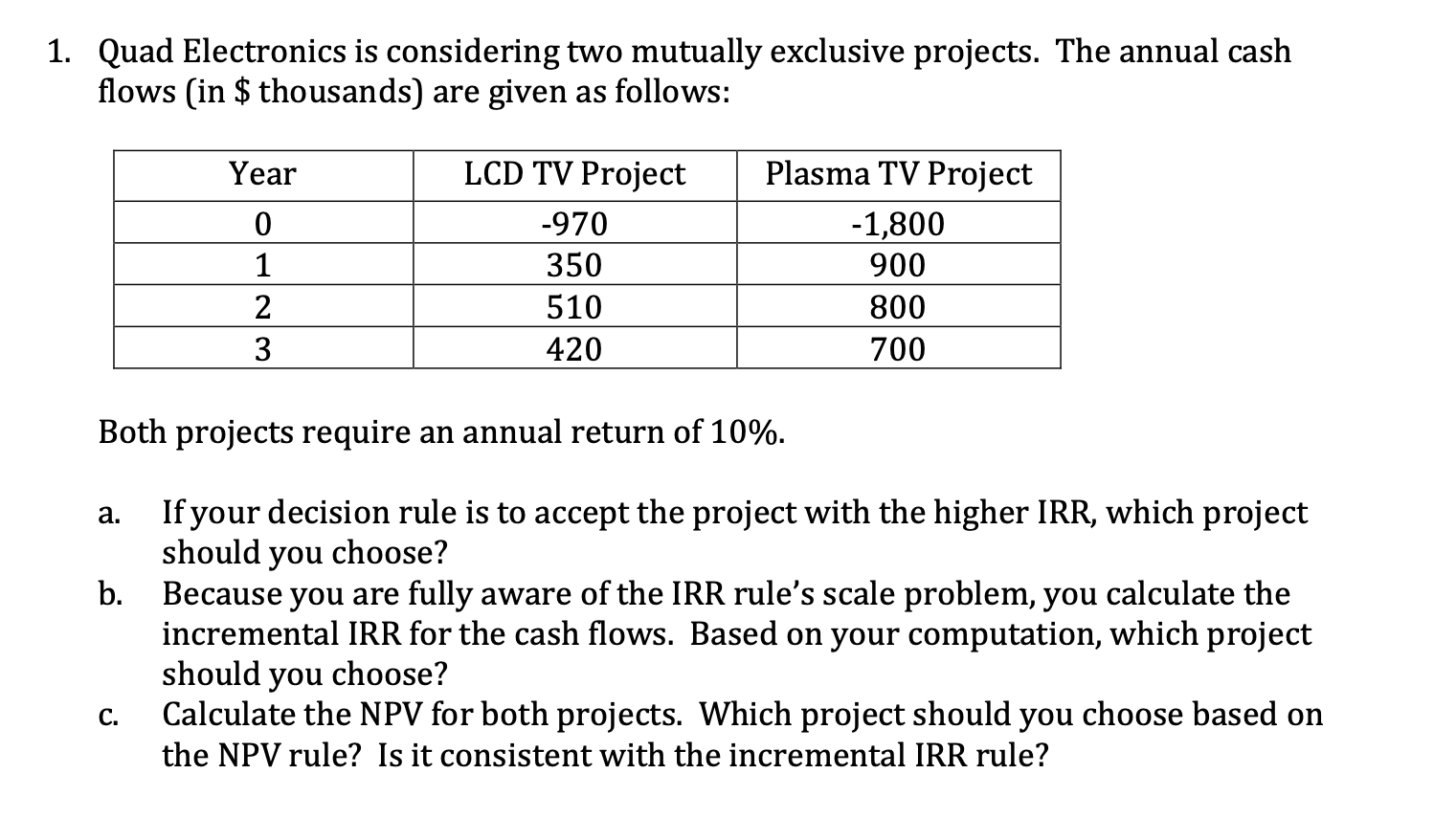

Question: 1. Quad Electronics is considering two mutually exclusive projects. The annual cash flows (in $ thousands) are given as follows: Year 0 1 2 3

1. Quad Electronics is considering two mutually exclusive projects. The annual cash flows (in $ thousands) are given as follows: Year 0 1 2 3 LCD TV Project -970 350 510 420 Plasma TV Project -1,800 900 800 700 Both projects require an annual return of 10%. a. b. If your decision rule is to accept the project with the higher IRR, which project should you choose? Because you are fully aware of the IRR rule's scale problem, you calculate the incremental IRR for the cash flows. Based on your computation, which project should you choose? Calculate the NPV for both projects. Which project should you choose based on the NPV rule? Is it consistent with the incremental IRR rule? c

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts