Question: ( 1 quad ) Net Present Value (NPV) Calculator begin{tabular}{ll|l|} hline 3 & hline 4 & Initial Investment & hline 5 & Annual

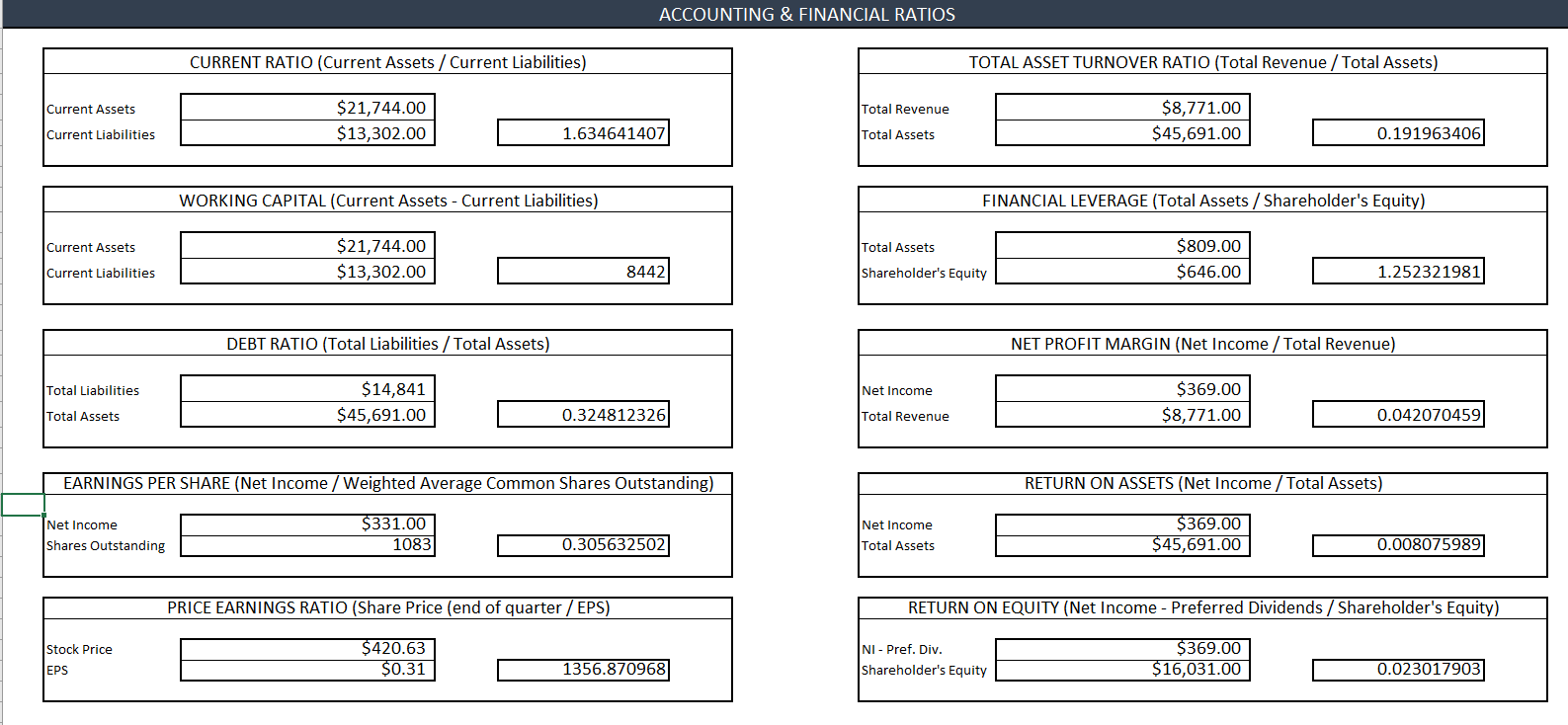

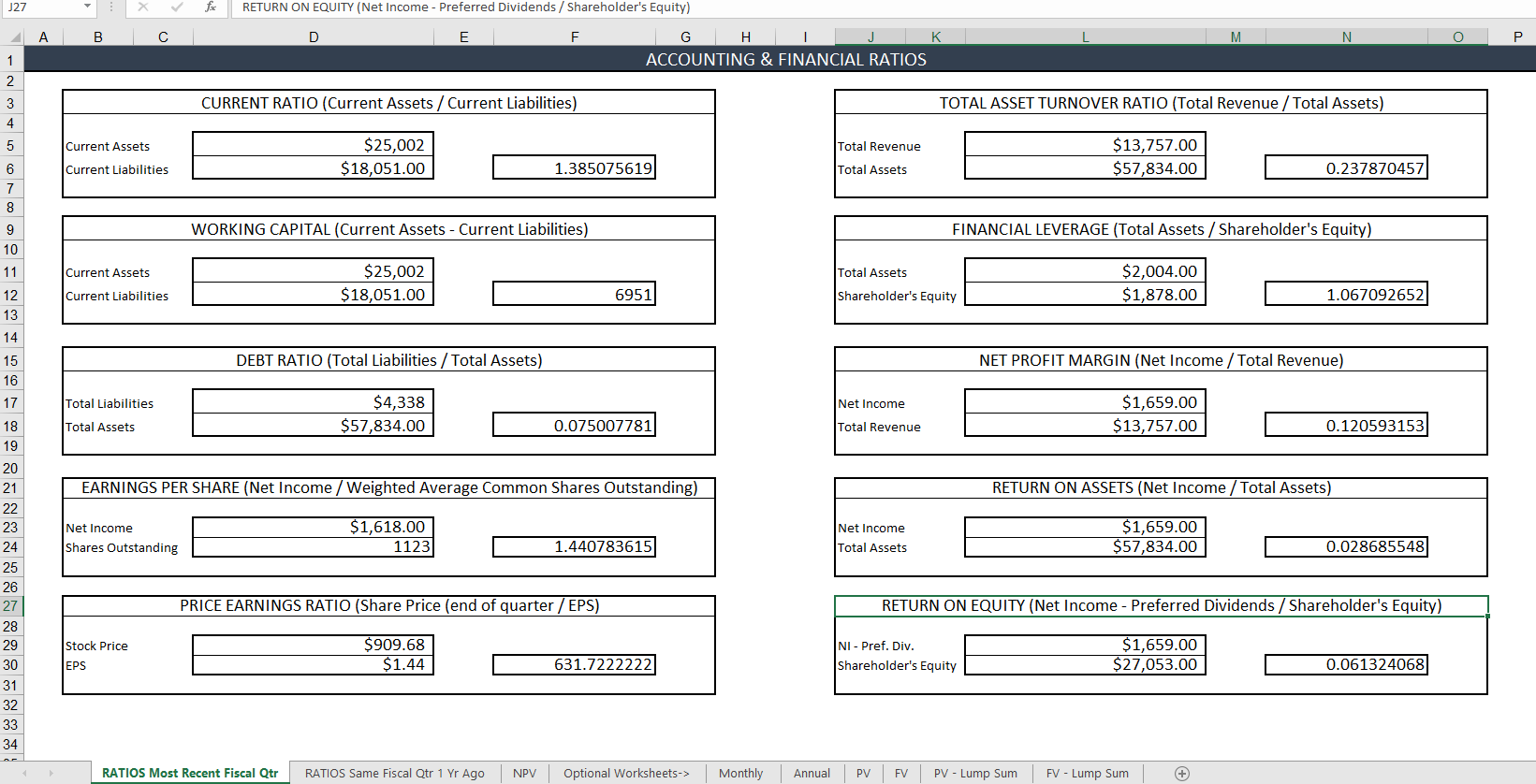

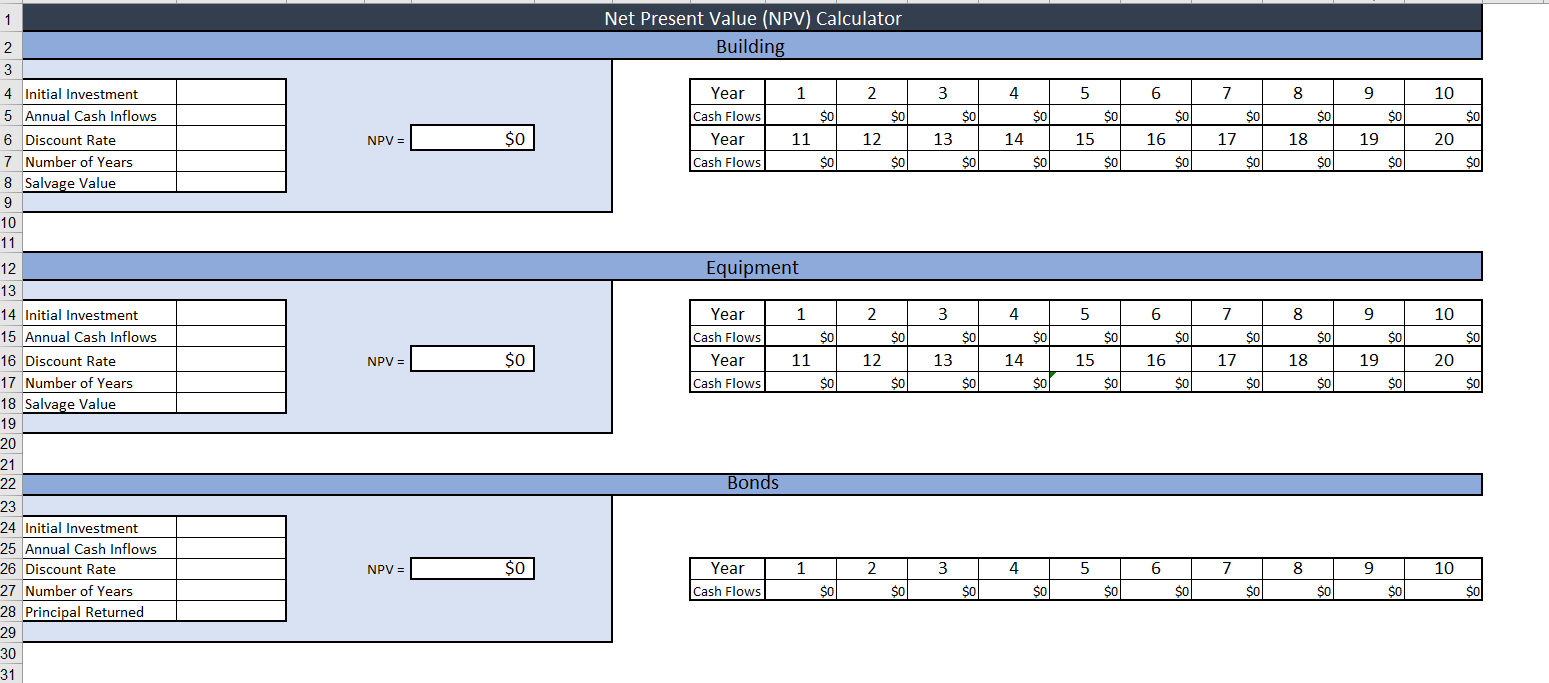

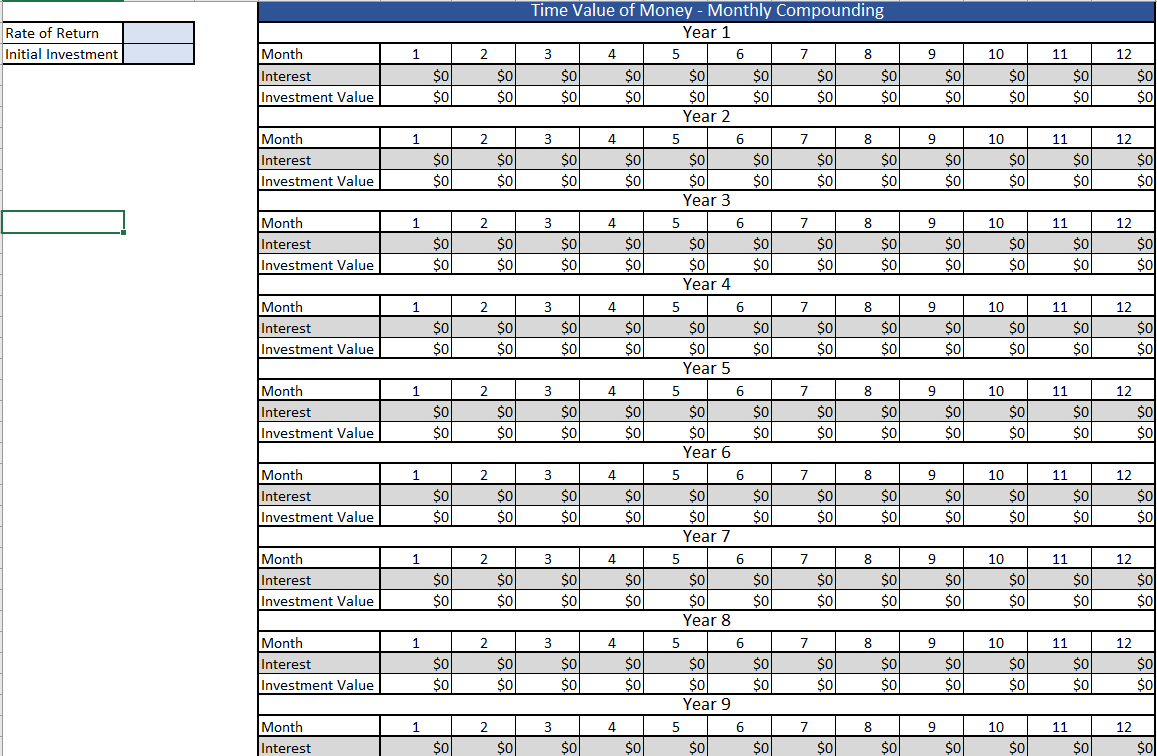

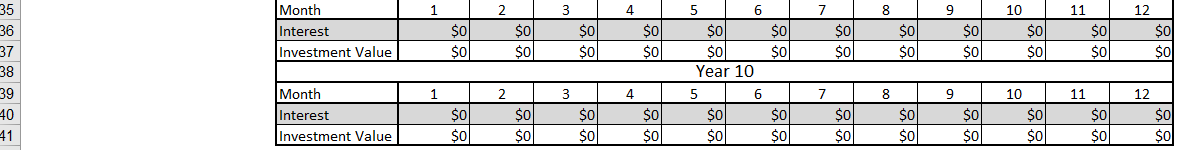

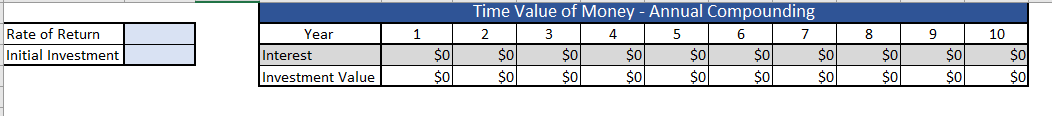

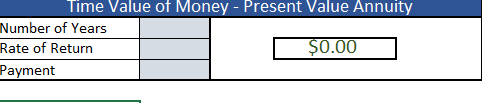

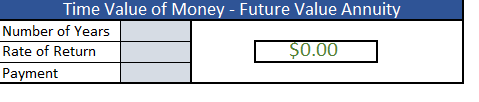

\\( 1 \\quad \\) Net Present Value (NPV) Calculator \\begin{tabular}{ll|l|} \\hline 3 & \\\\ \\hline 4 & Initial Investment & \\\\ \\hline 5 & Annual Cash Inflows & \\\\ 6 & Discount Rate & \\\\ 7 & Number of Years & \\\\ \\hline 8 & Salvage Value & \\\\ \\hline \\end{tabular} Building \\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \\hline Year & 1 & 2 & 3 & 4 & 5 & 6 & 7 & 8 & 9 & 10 \\\\ \\hline Cash Flows & \\( \\$_{0} \\) & \\( \\$_{0} \\) & \\( \\$_{0} \\) & \\( \\$_{0} \\) & \\( \\$_{0} \\) & \\( \\$_{0} \\) & \\( \\$_{0} \\) & \\( \\$_{0} \\) & \\( \\$_{0} \\) & \\( \\$_{0} \\) \\\\ \\hline Year & 11 & 12 & 13 & 14 & 15 & 16 & 17 & 18 & 19 & 20 \\\\ \\hline Cash Flows & \\( \\$_{0} \\) & \\( \\$_{0} \\) & \\( \\$_{0} \\) & \\( \\$_{0} \\) & \\( \\$_{0} \\) & \\( \\$_{0} \\) & \\( \\$_{0} \\) & \\( \\$_{0} \\) & \\( \\$_{0} \\) & \\( \\$_{0} \\) \\\\ \\hline \\end{tabular} Equipment \\[ \\mathrm{NPV}=\\mathrm{\\$} \\] Bonds Initial Investment 5 Annual Cash Inflows Discount Rate Number of Years \\[ \\mathrm{NPV}= \\] \\( \\$ 0 \\) \\[ \\mathrm{NPV}=\\square \\] Time Value of Money - Present Value of Lump Sum Time Value of Money - Present Value Annuity ACCOUNTING \\& FINANCIAL RATIOS \\begin{tabular}{|l|r|} \\hline \\multicolumn{2}{c|}{ CURRENT RATIO (Current Assets / Current Liabilities) } \\\\ \\hline \\multirow{3}{*}{\\( \\begin{array}{l}\\text { Current Assets } \\\\ \\text { Current Liabilities }\\end{array} \\)} & \\multicolumn{2}{|c|}{\\( \\$ 21,744.00 \\)} \\\\ \\cline { 2 - 3 } & \\( \\$ 13,302.00 \\) \\\\ \\hline \\end{tabular} \\begin{tabular}{|ll|} \\hline \\multicolumn{2}{|l|}{ WORKING CAPITAL (Current Assets - Current Liabilities) } \\\\ \\hline \\multirow{3}{*}{\\( \\begin{array}{l}\\text { Current Assets } \\\\ \\text { Current Liabilities }\\end{array} \\)} & \\( \\$ 21,744.00 \\) \\\\ \\cline { 2 - 3 } & \\( \\$ 13,302.00 \\) \\\\ \\hline \\end{tabular} \\begin{tabular}{|l|r|} \\hline \\multicolumn{2}{c|}{ DEBT RATIO (Total Liabilities / Total Assets) } \\\\ \\hline \\multirow{3}{*}{\\( \\begin{array}{r}\\text { Total Liabilities } \\\\ \\text { Total Assets }\\end{array} \\)} & \\( \\$ 14,841 \\) \\\\ \\cline { 2 - 3 } & \\( \\$ 45,691.00 \\) \\\\ \\hline \\end{tabular} \\begin{tabular}{|l|r|} \\hline \\multicolumn{2}{|c|}{ FINANCIAL LEVERAGE (Total Assets / Shareholder's Equity) } \\\\ \\hline \\multirow{2}{*}{\\( \\begin{array}{l}\\text { Total Assets } \\\\ \\text { Shareholder's Equity }\\end{array} \\)} & \\( \\$ 809.00 \\) \\\\ \\cline { 2 - 3 } & \\( \\$ 646.00 \\) \\\\ \\hline \\end{tabular} \\begin{tabular}{|l|r|} \\hline \\multicolumn{2}{|c|}{ NET PROFIT MARGIN (Net Income / Total Revenue) } \\\\ \\hline \\multirow{3}{*}{\\( \\begin{array}{l}\\text { Net Income } \\\\ \\text { Total Revenue }\\end{array} \\)} & \\( \\$ 369.00 \\) \\\\ \\cline { 2 - 3 } & \\( \\$ 8,771.00 \\) \\\\ \\hline \\end{tabular} Time Value of Money - Future Value Annuity \\begin{tabular}{|l|c|c|} \\hline \\multicolumn{2}{|c|}{ Time Value of Money - Future Value of Lump Sum } \\\\ \\hline Rate & & \\\\ \\hline Years & & \\( \\$ 0.00 \\) \\\\ \\hline Initial Investment & & \\\\ \\hline \\end{tabular} \\( 1 \\quad \\) Net Present Value (NPV) Calculator \\begin{tabular}{ll|l|} \\hline 3 & \\\\ \\hline 4 & Initial Investment & \\\\ \\hline 5 & Annual Cash Inflows & \\\\ 6 & Discount Rate & \\\\ 7 & Number of Years & \\\\ \\hline 8 & Salvage Value & \\\\ \\hline \\end{tabular} Building \\begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \\hline Year & 1 & 2 & 3 & 4 & 5 & 6 & 7 & 8 & 9 & 10 \\\\ \\hline Cash Flows & \\( \\$_{0} \\) & \\( \\$_{0} \\) & \\( \\$_{0} \\) & \\( \\$_{0} \\) & \\( \\$_{0} \\) & \\( \\$_{0} \\) & \\( \\$_{0} \\) & \\( \\$_{0} \\) & \\( \\$_{0} \\) & \\( \\$_{0} \\) \\\\ \\hline Year & 11 & 12 & 13 & 14 & 15 & 16 & 17 & 18 & 19 & 20 \\\\ \\hline Cash Flows & \\( \\$_{0} \\) & \\( \\$_{0} \\) & \\( \\$_{0} \\) & \\( \\$_{0} \\) & \\( \\$_{0} \\) & \\( \\$_{0} \\) & \\( \\$_{0} \\) & \\( \\$_{0} \\) & \\( \\$_{0} \\) & \\( \\$_{0} \\) \\\\ \\hline \\end{tabular} Equipment \\[ \\mathrm{NPV}=\\mathrm{\\$} \\] Bonds Initial Investment 5 Annual Cash Inflows Discount Rate Number of Years \\[ \\mathrm{NPV}= \\] \\( \\$ 0 \\) \\[ \\mathrm{NPV}=\\square \\] Time Value of Money - Present Value of Lump Sum Time Value of Money - Present Value Annuity ACCOUNTING \\& FINANCIAL RATIOS \\begin{tabular}{|l|r|} \\hline \\multicolumn{2}{c|}{ CURRENT RATIO (Current Assets / Current Liabilities) } \\\\ \\hline \\multirow{3}{*}{\\( \\begin{array}{l}\\text { Current Assets } \\\\ \\text { Current Liabilities }\\end{array} \\)} & \\multicolumn{2}{|c|}{\\( \\$ 21,744.00 \\)} \\\\ \\cline { 2 - 3 } & \\( \\$ 13,302.00 \\) \\\\ \\hline \\end{tabular} \\begin{tabular}{|ll|} \\hline \\multicolumn{2}{|l|}{ WORKING CAPITAL (Current Assets - Current Liabilities) } \\\\ \\hline \\multirow{3}{*}{\\( \\begin{array}{l}\\text { Current Assets } \\\\ \\text { Current Liabilities }\\end{array} \\)} & \\( \\$ 21,744.00 \\) \\\\ \\cline { 2 - 3 } & \\( \\$ 13,302.00 \\) \\\\ \\hline \\end{tabular} \\begin{tabular}{|l|r|} \\hline \\multicolumn{2}{c|}{ DEBT RATIO (Total Liabilities / Total Assets) } \\\\ \\hline \\multirow{3}{*}{\\( \\begin{array}{r}\\text { Total Liabilities } \\\\ \\text { Total Assets }\\end{array} \\)} & \\( \\$ 14,841 \\) \\\\ \\cline { 2 - 3 } & \\( \\$ 45,691.00 \\) \\\\ \\hline \\end{tabular} \\begin{tabular}{|l|r|} \\hline \\multicolumn{2}{|c|}{ FINANCIAL LEVERAGE (Total Assets / Shareholder's Equity) } \\\\ \\hline \\multirow{2}{*}{\\( \\begin{array}{l}\\text { Total Assets } \\\\ \\text { Shareholder's Equity }\\end{array} \\)} & \\( \\$ 809.00 \\) \\\\ \\cline { 2 - 3 } & \\( \\$ 646.00 \\) \\\\ \\hline \\end{tabular} \\begin{tabular}{|l|r|} \\hline \\multicolumn{2}{|c|}{ NET PROFIT MARGIN (Net Income / Total Revenue) } \\\\ \\hline \\multirow{3}{*}{\\( \\begin{array}{l}\\text { Net Income } \\\\ \\text { Total Revenue }\\end{array} \\)} & \\( \\$ 369.00 \\) \\\\ \\cline { 2 - 3 } & \\( \\$ 8,771.00 \\) \\\\ \\hline \\end{tabular} Time Value of Money - Future Value Annuity \\begin{tabular}{|l|c|c|} \\hline \\multicolumn{2}{|c|}{ Time Value of Money - Future Value of Lump Sum } \\\\ \\hline Rate & & \\\\ \\hline Years & & \\( \\$ 0.00 \\) \\\\ \\hline Initial Investment & & \\\\ \\hline \\end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts