Question: 1. QUESTION 1 Luke is a very precise guy and he's also very passionate about accounting. On December 31*, 2019, he opened his Excel Spreadsheet

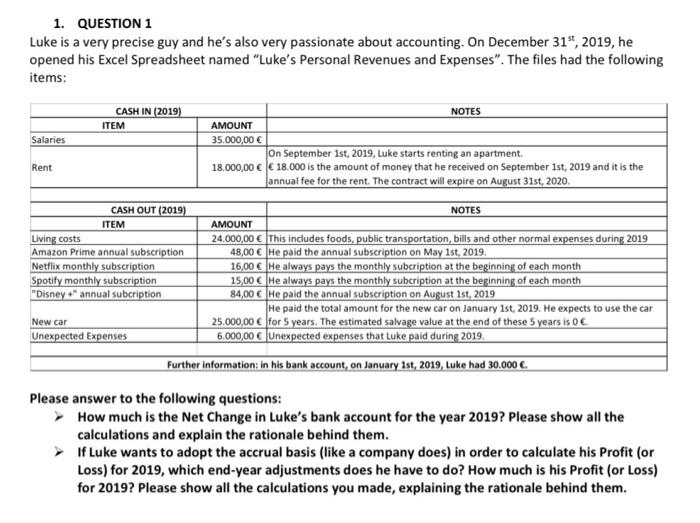

1. QUESTION 1 Luke is a very precise guy and he's also very passionate about accounting. On December 31*, 2019, he opened his Excel Spreadsheet named "Luke's Personal Revenues and Expenses". The files had the following items: CASH IN (2019) ITEM Salaries NOTES AMOUNT 35.000,00 On September 1st, 2019, Luke starts renting an apartment. 18.000,00 18.000 is the amount of money that he received on September 1st, 2019 and it is the annual fee for the rent. The contract will expire on August 31st, 2020 Rent CASH OUT (2019) ITEM Living costs Amazon Prime annual subscription Netflix monthly subscription Spotify monthly subscription "Disney" annual subcription NOTES AMOUNT 24.000,00 This includes foods, public transportation, bills and other normal expenses during 2019 48,00 He paid the annual subscription on May 1st, 2019 16,00 He always pays the monthly subcription at the beginning of each month 15,00 He always pays the monthly subcription at the beginning of each month 84,00 He paid the annual subscription on August 1st, 2019 He paid the total amount for the new car on January 1st, 2019. He expects to use the car 25.000,00 for 5 years. The estimated salvage value at the end of these 5 years is 06. 6.000,00 Unexpected expenses that Luke paid during 2019. New car Unexpected Expenses Further information; in his bank account, on January 1st, 2019, Luke had 30.000 Please answer to the following questions: How much is the Net Change in Luke's bank account for the year 2019? Please show all the calculations and explain the rationale behind them. If Luke wants to adopt the accrual basis (like a company does) in order to calculate his Profit (or Loss) for 2019, which end-year adjustments does he have to do? How much is his Profit (or Loss) for 2019? Please show all the calculations you made, explaining the rationale behind them. 1. QUESTION 1 Luke is a very precise guy and he's also very passionate about accounting. On December 31*, 2019, he opened his Excel Spreadsheet named "Luke's Personal Revenues and Expenses". The files had the following items: CASH IN (2019) ITEM Salaries NOTES AMOUNT 35.000,00 On September 1st, 2019, Luke starts renting an apartment. 18.000,00 18.000 is the amount of money that he received on September 1st, 2019 and it is the annual fee for the rent. The contract will expire on August 31st, 2020 Rent CASH OUT (2019) ITEM Living costs Amazon Prime annual subscription Netflix monthly subscription Spotify monthly subscription "Disney" annual subcription NOTES AMOUNT 24.000,00 This includes foods, public transportation, bills and other normal expenses during 2019 48,00 He paid the annual subscription on May 1st, 2019 16,00 He always pays the monthly subcription at the beginning of each month 15,00 He always pays the monthly subcription at the beginning of each month 84,00 He paid the annual subscription on August 1st, 2019 He paid the total amount for the new car on January 1st, 2019. He expects to use the car 25.000,00 for 5 years. The estimated salvage value at the end of these 5 years is 06. 6.000,00 Unexpected expenses that Luke paid during 2019. New car Unexpected Expenses Further information; in his bank account, on January 1st, 2019, Luke had 30.000 Please answer to the following questions: How much is the Net Change in Luke's bank account for the year 2019? Please show all the calculations and explain the rationale behind them. If Luke wants to adopt the accrual basis (like a company does) in order to calculate his Profit (or Loss) for 2019, which end-year adjustments does he have to do? How much is his Profit (or Loss) for 2019? Please show all the calculations you made, explaining the rationale behind them

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts