Question: 1 QUESTION 1 _ ( Risk and Return ) . Marks ) a . The income statement of Softy Ltd for the past year is

QUESTIONRisk and Return

Marks

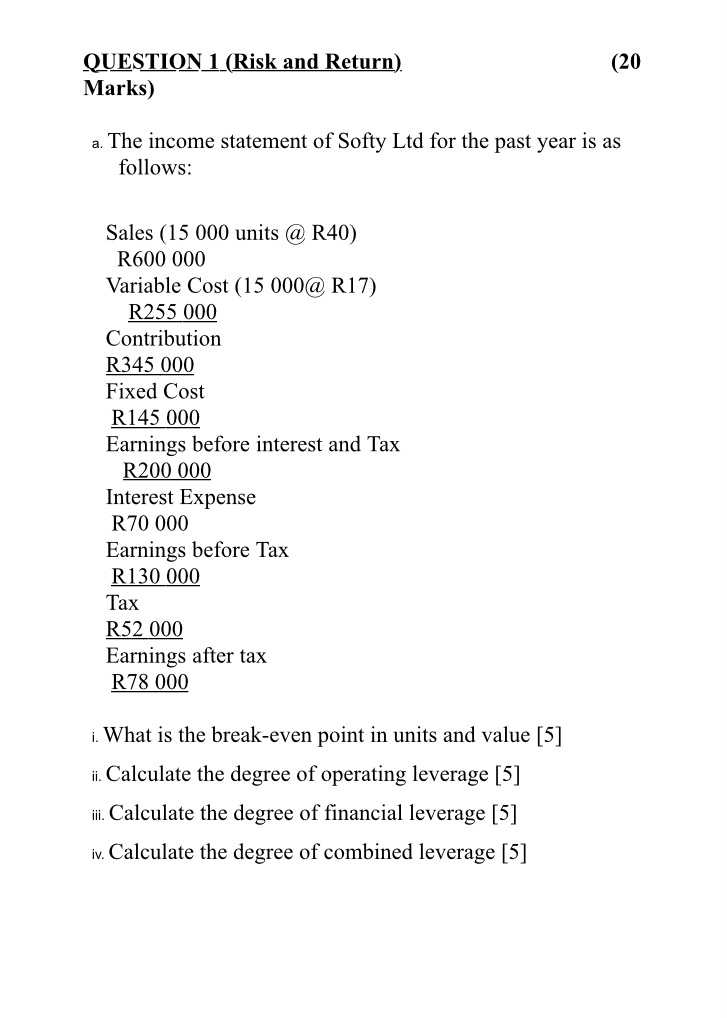

a The income statement of Softy Ltd for the past year is as follows:

Sales units @ R

R

Variable Cost@ R

Contribution

R

Fixed Cost

R

Earnings before interest and Tax

R

Interest Expense

R

Earnings before Tax

R

Tax

R

Earnings after tax

i What is the breakeven point in units and value

ii Calculate the degree of operating leverage

iii. Calculate the degree of financial leverage

iv Calculate the degree of combined leverage

QUESTION Risk and Return

Marks

a The income statement of Softy Ltd for the past year is as follows:

Sales units @ R

R

Variable Cost@ R

Contribution

R

Fixed Cost

R

Earnings before interest and Tax

R

Interest Expense

R

Earnings before Tax

R

Tax

R

Earnings after tax

i What is the breakeven point in units and value

ii Calculate the degree of operating leverage

iii. Calculate the degree of financial leverage

iv Calculate the degree of combined leverage

QUESTION Risk and Return

Marks

a The income statement of Softy Ltd for the past year is as follows:

Sales units @ R

R

Variable Cost@ R

Contribution

R

Fixed Cost

R

Earnings before interest and Tax

R

Interest Expense

R

Earnings before Tax

R

Tax

R

Earnings after tax

i What is the breakeven point in units and value

ii Calculate the degree of operating leverage

iii. Calculate the degree of financial leverage

iv Calculate the degree of combined leverage

all Vodacom

:

@

QUESTION Risk and Return

Marks

a The income statement of Softy Ltd for the past year is as follows: RInterest ExpenseREarnings before TaxRTaxunderlineR

Earnings after tax

i What is the breakeven point in units and value

ii Calculate the degree of operating leverage

iii. Calculate the degree of financial leverage

iv Calculate the degree of combined leverage

QUESTION Risk and Return

Marks

Following extensive analysis and forecasting, you have

QUESTIONRisk and Return

Marks

a The income statement of Softy Ltd for the past year is as follows:

Sales units @ R

R

Variable Cost@R

R

Contribution

R

Fixed Cost

R

Earnings before interest and Tax R

Interest Expense

R

Earnings before Tax

R

Tax

R

Earnings after tax

i What is the breakeven point in units and value

ii Calculate the degree of operating leverage

iii. Calculate the degree of financial leverage

iv Calculate the degree of combined leverage

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock