Question: --/1 Question 1 View Policies Current Attempt in Progress On July 1, 2019. Crane Company purchased new equipment for $75,000. Its estimated useful life was

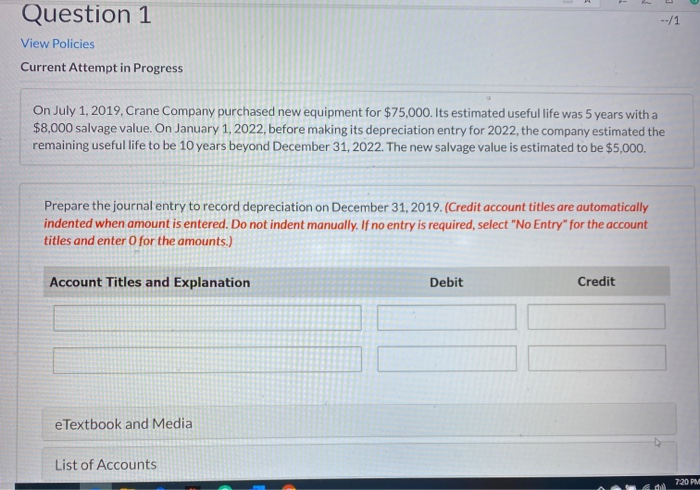

--/1 Question 1 View Policies Current Attempt in Progress On July 1, 2019. Crane Company purchased new equipment for $75,000. Its estimated useful life was 5 years with a $8,000 salvage value. On January 1, 2022, before making its depreciation entry for 2022, the company estimated the remaining useful life to be 10 years beyond December 31, 2022. The new salvage value is estimated to be $5,000. Prepare the journal entry to record depreciation on December 31, 2019. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Account Titles and Explanation Debit Credit eTextbook and Media List of Accounts 720 PM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts