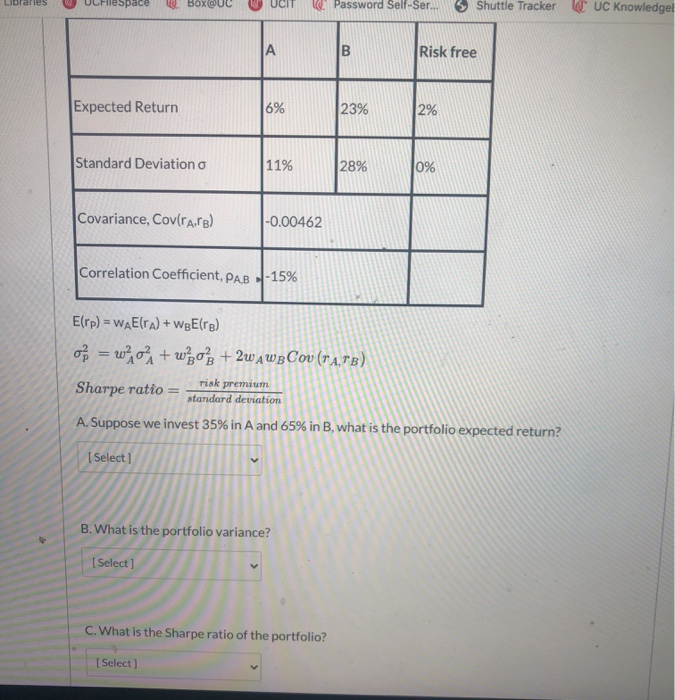

Question: 1 question 3 parts Libraries pace Box@UC @ Password Self-Ser... Shuttle Tracker CUC Knowledgel | 00 Risk free Expected Return 16% 23% 2% Standard Deviation

Libraries pace Box@UC @ Password Self-Ser... Shuttle Tracker CUC Knowledgel | 00 Risk free Expected Return 16% 23% 2% Standard Deviation o 11% 28% 0% Covariance, Cov(rare) -0.00462 Correlation Coefficient, PAB -15% E(rp) = WAE(ra) + WBE(rs) w"+ wzo+2WAWBCov (rarb) Sharpe ratio risk premium standard deviation A. Suppose we invest 35% in A and 65% in B, what is the portfolio expected return? Select] B. What is the portfolio variance? [Select] C. What is the Sharpe ratio of the portfolio? [Select]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts