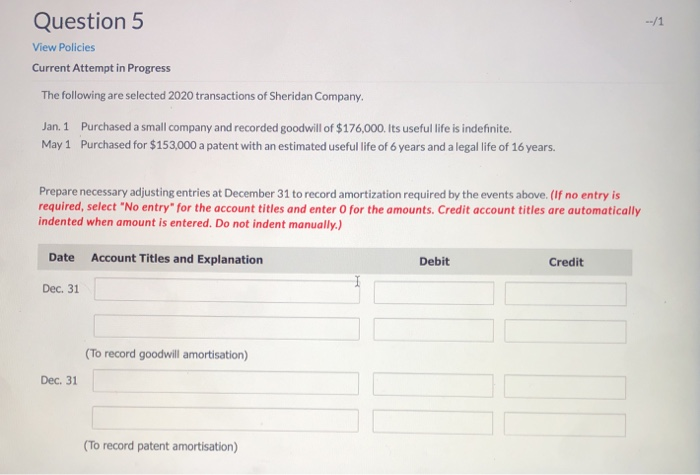

Question: --/1 Question 5 View Policies Current Attempt in Progress The following are selected 2020 transactions of Sheridan Company. Jan. 1 Purchased a small company and

--/1 Question 5 View Policies Current Attempt in Progress The following are selected 2020 transactions of Sheridan Company. Jan. 1 Purchased a small company and recorded goodwill of $176,000. Its useful life is indefinite. May 1 Purchased for $153,000 a patent with an estimated useful life of 6 years and a legal life of 16 years. Prepare necessary adjusting entries at December 31 to record amortization required by the events above. (If no entry is required, select "No entry" for the account titles and enter for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31 (To record goodwill amortisation) Dec. 31 (To record patent amortisation)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts