Question: 1 QUESTION ONE Answer all six questions. Refer to sections of the Income Tax Assessment Acts, the Fringe Benefits Tax Assessment Act, A New Tax

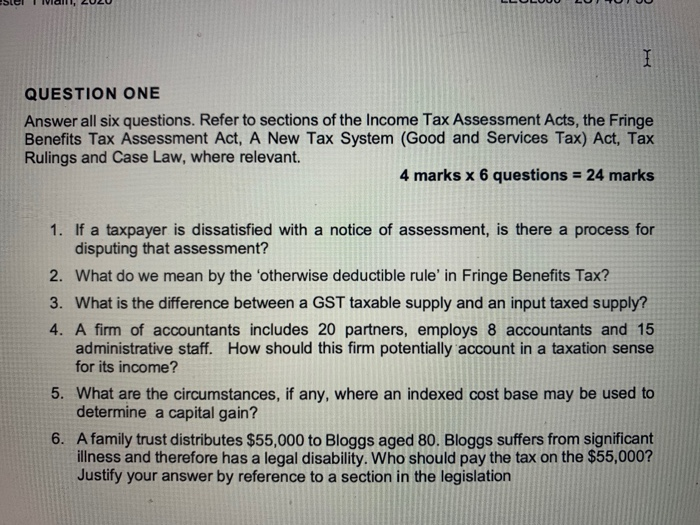

1 QUESTION ONE Answer all six questions. Refer to sections of the Income Tax Assessment Acts, the Fringe Benefits Tax Assessment Act, A New Tax System (Good and Services Tax) Act, Tax Rulings and Case Law, where relevant. 4 marks x 6 questions = 24 marks 1. If a taxpayer is dissatisfied with a notice of assessment, is there a process for disputing that assessment? 2. What do we mean by the 'otherwise deductible rule' in Fringe Benefits Tax? 3. What is the difference between a GST taxable supply and an input taxed supply? 4. A firm of accountants includes 20 partners, employs 8 accountants and 15 administrative staff. How should this firm potentially account in a taxation sense for its income? 5. What are the circumstances, if any, where an indexed cost base may be used to determine a capital gain? 6. A family trust distributes $55,000 to Bloggs aged 80. Bloggs suffers from significant illness and therefore has a legal disability. Who should pay the tax on the $55,000? Justify your answer by reference to a section in the legislation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts