Question: 1 Question What you have learnt from this case ? 2 and what alternative solution you provide? 19:56 *0 29 NO... 23 22 CASE Reading

1 Question

What you have learnt from this case ?

2 and what alternative solution you provide?

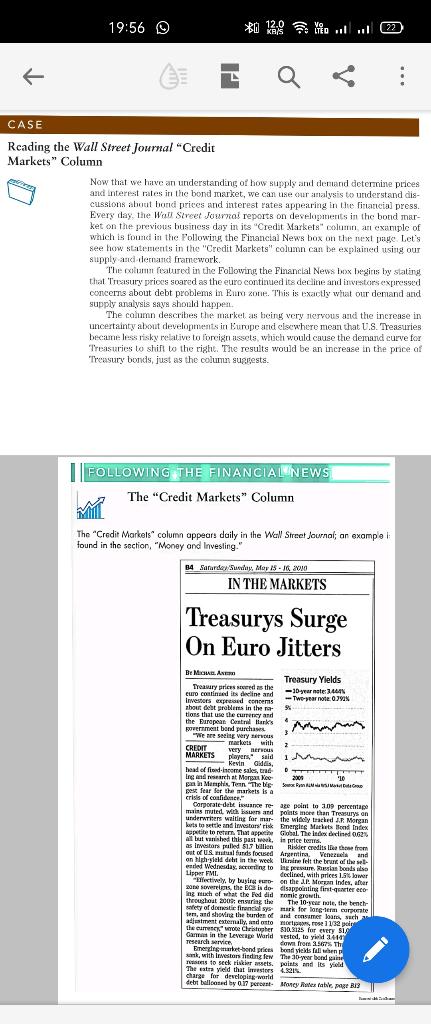

19:56 *0 29 NO... 23 22 CASE Reading the Wall Street Journal "Credit Markets" Column Now that we have an understanding of how supply and demand determine prices and interest rates in the bond market, we can use our analysis to understand dis- cussions about bond prices and interest rates appearing in the financial press Every day, the Wall Street Journal reports on developments in the bond mar- ket on the previous business day in its "Credit Markets" column an example of which is found in the following the Financial News box on the next page Let's see how statements in the "Credit Markets" column can be explained using our supply and der and framework. The exolumn featured in the following the Financial News box begins Ivy stating that Treasury prious soared as the euro continued its decline and investors expressed " concerns about debt problems in Eurozone. This is exactly what our demand and supply analysis says should happen The column describes the market as being very nervous and the increase in uncertainty about developments in Europe and disewhere mean that U.S. Treasures became less risky relative to foreign assets, which would cause the demand curve for Treasures to shift to the right. The results would be an increase in the price of Treasury bonds, just as the column sustests. FOLLOWING THE FINANCIAL NEWS The "Credit Markets" Column The "Credit Markals" column appears daily in the Wall Street Journal or example found in the section, "Money and Investing 34 Saturday Suwhy, May 15-16 2010 IN THE MARKETS Treasurys Surge On Euro Jitters Be Migue. A Treasury Yields Treasury pries red as the 10 year nate: 2016 ELITO continued sine and Investors expecod concerns -Two-year note:0.90 about det roems in the tions that use the currency and the European Central Park's 4 power band purchases We are very CREO markets with 2 MARKETS veryder - players," said Kevin Giddis. head of fondemekte D ing and research at Maroko 2008 '10 gan Memphis, Ten Thee See . " Best fear for the markets is a crisis of confidence." Corporate debt isance reaze point to 100 percentage mains uted with Band points more than Treasurys on 3.9 underwriters waiting for mer ihre widely tracked J. Morgan arts to see and livestors' risk Emerging Markets Bond Index appetite to return. That appeal. The disdedined 62% All uthed this past week, in price terms. as investorsmiled out of US malfunds focused Arentina, Venere alled sl. bilion Riser credits like these from on Highland debut in the week Uhrine felt the brand of these Venezoland eared Wednesday, cutting to see. Besian bonds also Lipper MI declined, with prices 1.56 war "Effectively by buying up on the Moon Indes, after 2012 sovereigns, the cols do disappointing fint-garter eco on the Inz nach of what the Fed did for online grater eco to growth. throughout 2008 energth The 10-year hits, the bench : safety of domestie felis mark for long-term curate ter, and showing the burden of and come loans, such adjustment esternally, and to rose 11/32 po the crew Christopher $30.3125 for every $10 no Garut in the Leverage World vested to yield 3410 Tesearch vice down from 25.675. The Emerging market-bond prices on tekis fallen ank, with love to finding few The 3-year bondant Sto seek riskiereis. puists and its yold The este vied that investors 4.821% charge for developing world debt beloond by in percent. Money watepage BI? 19:56 *0 29 NO... 23 22 CASE Reading the Wall Street Journal "Credit Markets" Column Now that we have an understanding of how supply and demand determine prices and interest rates in the bond market, we can use our analysis to understand dis- cussions about bond prices and interest rates appearing in the financial press Every day, the Wall Street Journal reports on developments in the bond mar- ket on the previous business day in its "Credit Markets" column an example of which is found in the following the Financial News box on the next page Let's see how statements in the "Credit Markets" column can be explained using our supply and der and framework. The exolumn featured in the following the Financial News box begins Ivy stating that Treasury prious soared as the euro continued its decline and investors expressed " concerns about debt problems in Eurozone. This is exactly what our demand and supply analysis says should happen The column describes the market as being very nervous and the increase in uncertainty about developments in Europe and disewhere mean that U.S. Treasures became less risky relative to foreign assets, which would cause the demand curve for Treasures to shift to the right. The results would be an increase in the price of Treasury bonds, just as the column sustests. FOLLOWING THE FINANCIAL NEWS The "Credit Markets" Column The "Credit Markals" column appears daily in the Wall Street Journal or example found in the section, "Money and Investing 34 Saturday Suwhy, May 15-16 2010 IN THE MARKETS Treasurys Surge On Euro Jitters Be Migue. A Treasury Yields Treasury pries red as the 10 year nate: 2016 ELITO continued sine and Investors expecod concerns -Two-year note:0.90 about det roems in the tions that use the currency and the European Central Park's 4 power band purchases We are very CREO markets with 2 MARKETS veryder - players," said Kevin Giddis. head of fondemekte D ing and research at Maroko 2008 '10 gan Memphis, Ten Thee See . " Best fear for the markets is a crisis of confidence." Corporate debt isance reaze point to 100 percentage mains uted with Band points more than Treasurys on 3.9 underwriters waiting for mer ihre widely tracked J. Morgan arts to see and livestors' risk Emerging Markets Bond Index appetite to return. That appeal. The disdedined 62% All uthed this past week, in price terms. as investorsmiled out of US malfunds focused Arentina, Venere alled sl. bilion Riser credits like these from on Highland debut in the week Uhrine felt the brand of these Venezoland eared Wednesday, cutting to see. Besian bonds also Lipper MI declined, with prices 1.56 war "Effectively by buying up on the Moon Indes, after 2012 sovereigns, the cols do disappointing fint-garter eco on the Inz nach of what the Fed did for online grater eco to growth. throughout 2008 energth The 10-year hits, the bench : safety of domestie felis mark for long-term curate ter, and showing the burden of and come loans, such adjustment esternally, and to rose 11/32 po the crew Christopher $30.3125 for every $10 no Garut in the Leverage World vested to yield 3410 Tesearch vice down from 25.675. The Emerging market-bond prices on tekis fallen ank, with love to finding few The 3-year bondant Sto seek riskiereis. puists and its yold The este vied that investors 4.821% charge for developing world debt beloond by in percent. Money watepage BI

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts