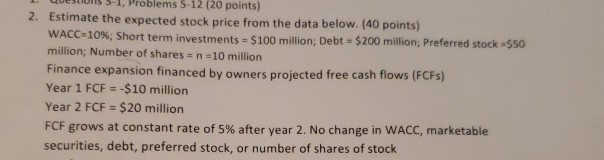

Question: 1. Questun 5-1, Problems 5-12 (20 points) 2. Estimate the expected stock price from the data below. (40 points) WACC 10%; Short term investments =

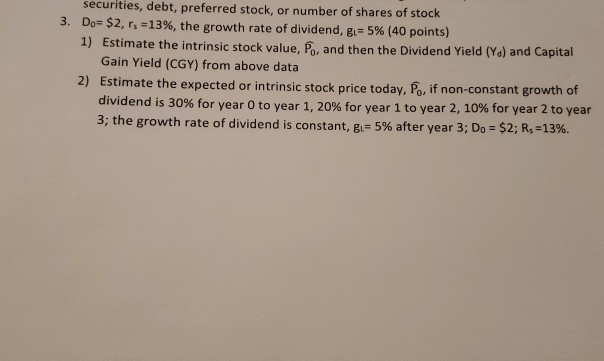

1. Questun 5-1, Problems 5-12 (20 points) 2. Estimate the expected stock price from the data below. (40 points) WACC 10%; Short term investments = $100 million; Debt = $200 million, Preferred stock 550 million; Number of shares = n = 10 million Finance expansion financed by owners projected free cash flows (FCFS) Year 1 FCF = -$10 million Year 2 FCF = $20 million FCF grows at constant rate of 5% after year 2. No change in WACC, marketable securities, debt, preferred stock, or number of shares of stock securities, debt, preferred stock, or number of shares of stock 3. Do= $2, rs = 13%, the growth rate of dividend, gu= 5% (40 points) 1) Estimate the intrinsic stock value, Po, and then the Dividend Yield (Y) and Capital Gain Yield (CGY) from above data 2) Estimate the expected or intrinsic stock price today, Po, if non-constant growth of dividend is 30% for year 0 to year 1, 20% for year 1 to year 2, 10% for year 2 to year 3; the growth rate of dividend is constant, Bu=5% after year 3; Do = $2; R. =13%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts