Question: 1. Quick ratios between 0.5 and 1 are considered satisfactory, as long as the collection of receivables is not expected to slow. Does the client,

1. Quick ratios between 0.5 and 1 are considered satisfactory, as long as the collection of receivables is not expected to slow. Does the client, Choice Hotels, have enough current assets to meet the payment schedule of current liabilities with a margin of safety?

2. Which of the above ratios would you use to determine which company, Choice Hotels or Marriott International, is more attractive for an acquisition by the equity firm and why?

3. Which company would you invest in and why? Has your decision changed after you computed the above ratios?

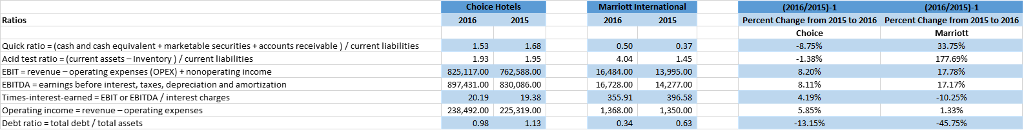

Choice Hotels Ratios 2016 2015 Percent Change from 201S to 2016 Percent Change from 2015 to 2016 Quick ratio (cash and cash equivalent marketable securities accounts receivable) /current liabilities Acid test ratio (current assets- Inventory)/current liabilities EBIT-revenue-operating expenses(OPEX) + nonoperating income BITDA-earnings before interest, taxes, depreciation and amortization Times-interest-eamed EBIT or EBITDA/interest charges Operating incomerevenue-operating expernses Debt ratio total debt/total assets 1.68 1.95 825,117.00 762,588.00 897431.00 830,086.00 19.38 238,492.00 225,319.00 Choice -0.75% L 38% 3.20% 8.11% 4.19% 5.85% Marriott 33.75% 177.69% 17.78% 17.17% 1.53 0.37 1.45 16,484.00 13,955.00 14,277.00 3%,58 1,368.001,350.00 0.50 4.04 16,728.00 355.91 20.19 . 1.33% 0.99 0.34

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts