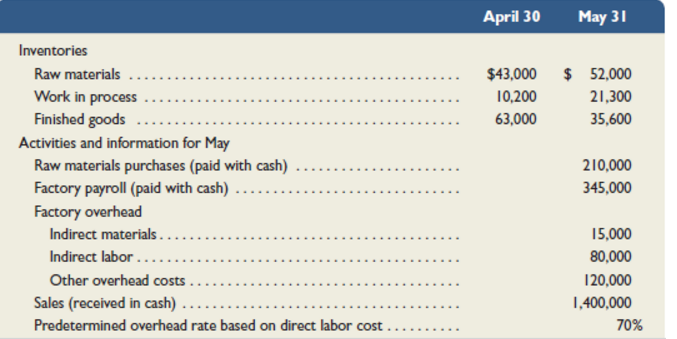

Question: 1. Raw materials purchases for cash. 2. Direct materials usage. 3. Indirect materials usage. 4.Direct labor usage. 5.Indirect labor usage. 6.Total payroll paid in cash.

1. Raw materials purchases for cash.

2. Direct materials usage.

3. Indirect materials usage.

4.Direct labor usage.

5.Indirect labor usage.

6.Total payroll paid in cash.

7.Incurred other overhead costs (record credit to Other Accounts).

8.Application of overhead to work in process.

9.. Prepare the journal entry to allocate (close) overapplied or underapplied overhead to Cost of Goods Sold.

-----Journal entries and please show calculations

April 30 May 31 Inventories 21,300 35,600 Activities and information for May 210,000 345,000 Raw materials purchases (paid with cash) . . . .. . .. . . . Factory overhead 15,000 80,000 20,000 1400,000 Predetermined overhead rate based on direct labor cost . . . . . 70%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts