Question: 1. Realized gains and losses from trading securities arise from: A.the sale of the investment. B.changes in the market value of the investment. C.both the

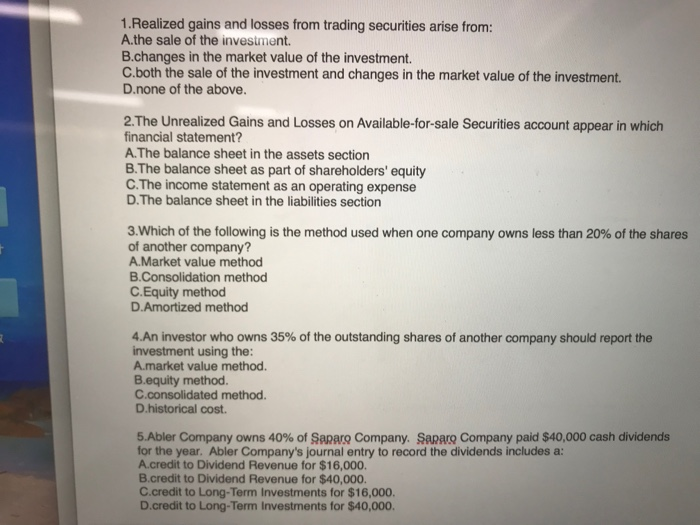

1. Realized gains and losses from trading securities arise from: A.the sale of the investment. B.changes in the market value of the investment. C.both the sale of the investment and changes in the market value of the investment. D.none of the above. 2. The Unrealized Gains and Losses on Available-for-sale Securities account appear in which financial statement? A. The balance sheet in the assets section B. The balance sheet as part of shareholders' equity C. The income statement as an operating expense D. The balance sheet in the liabilities section 3. Which of the following is the method used when one company owns less than 20% of the shares of another company? A. Market value method B.Consolidation method C.Equity method D.Amortized method 4.An investor who owns 35% of the outstanding shares of another company should report the investment using the: A.market value method. B.equity method. C.consolidated method. D.historical cost 5.Abler Company owns 40% of Sararo Company. Sanaro Company paid $40,000 cash dividends for the year. Abler Company's journal entry to record the dividends includes a: A.credit to Dividend Revenue for $16,000. B.credit to Dividend Revenue for $40,000. C.credit to Long-Term Investments for $16,000. D.credit to Long-Term Investments for $40,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts