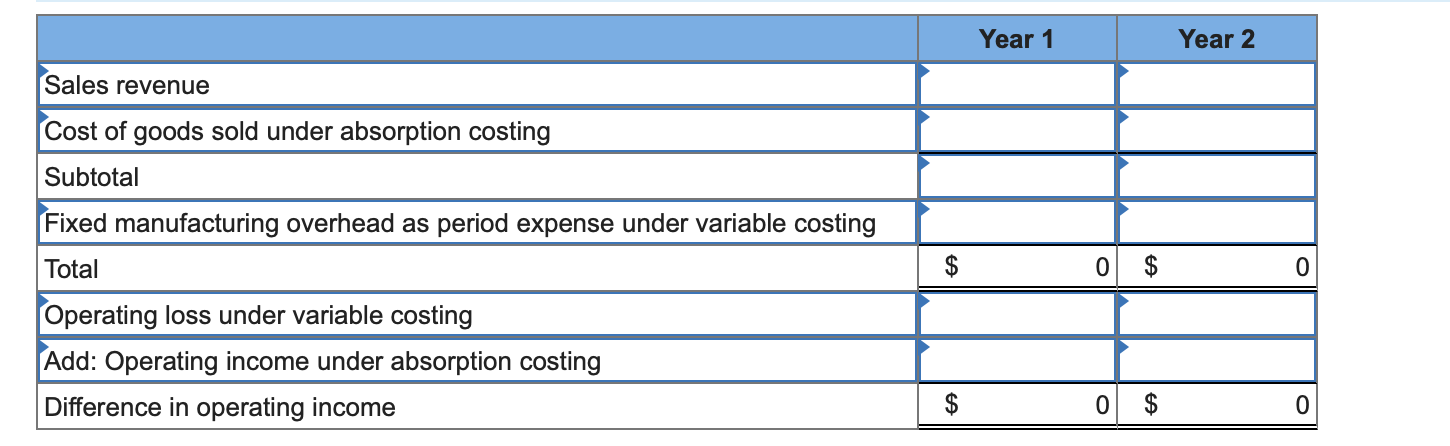

Question: 1. Reconcile Lehightons operating income reported under absorption and variable costing, during each year, by comparing the following two amounts on each income statement: Cost

1. Reconcile Lehightons operating income reported under absorption and variable costing, during each year, by comparing the following two amounts on each income statement:

- Cost of goods sold

- Fixed cost (expensed as a period expense)

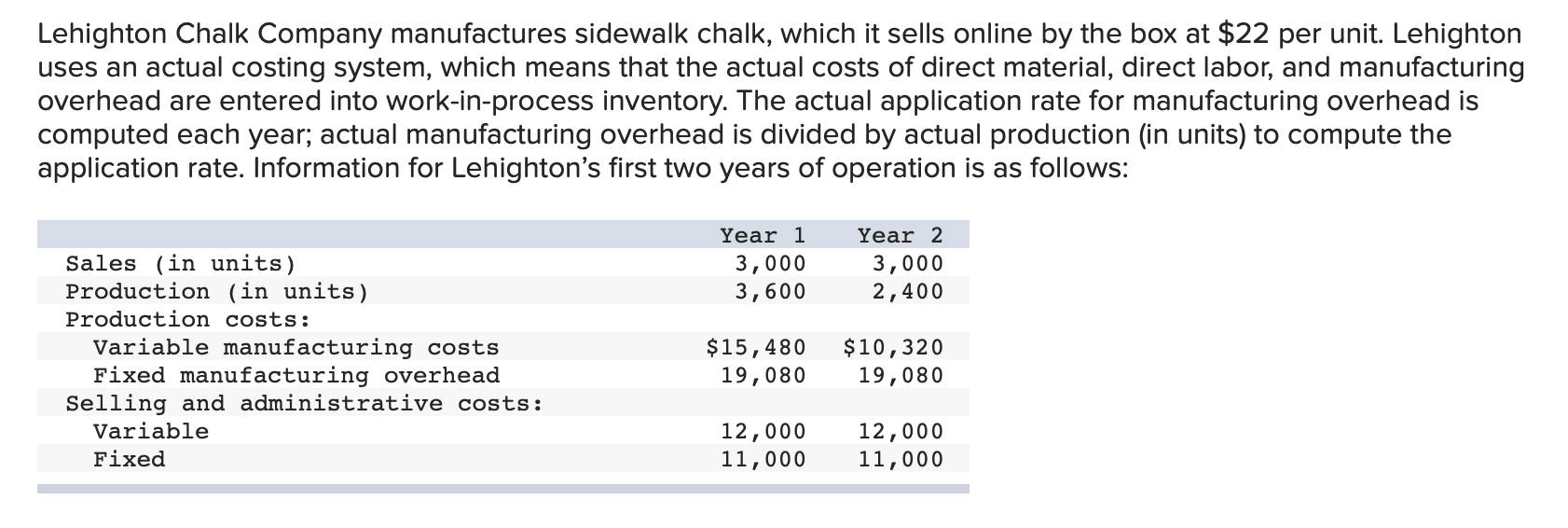

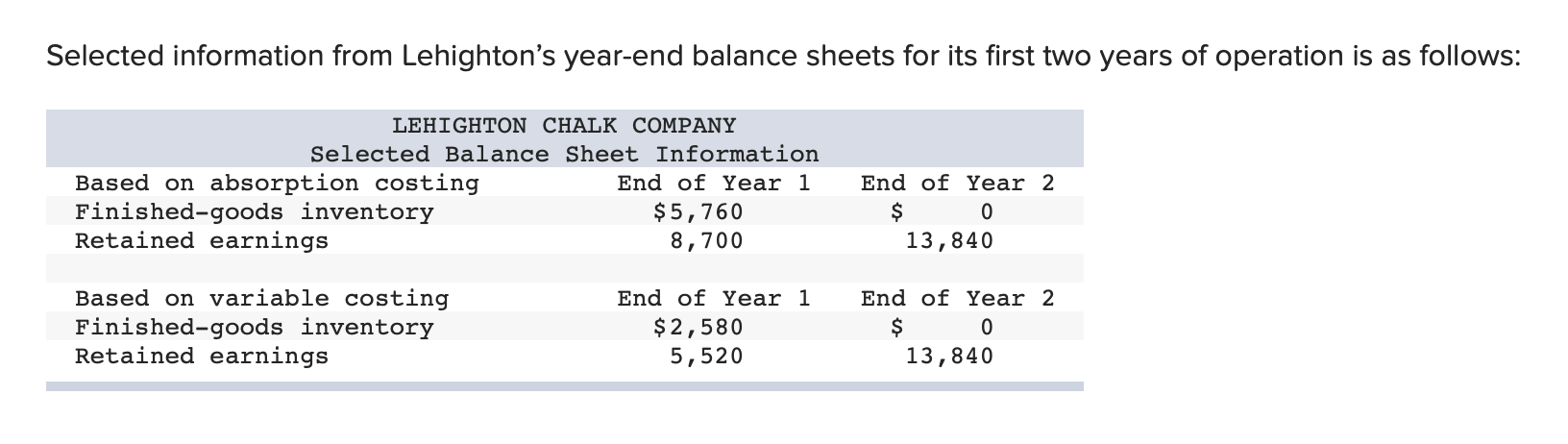

Lehighton Chalk Company manufactures sidewalk chalk, which it sells online by the box at $22 per unit. Lehighton uses an actual costing system, which means that the actual costs of direct material, direct labor, and manufacturing overhead are entered into work-in-process inventory. The actual application rate for manufacturing overhead is computed each year; actual manufacturing overhead is divided by actual production (in units) to compute the application rate. Information for Lehighton's first two years of operation is as follows: Year 1 3,000 3,600 Year 2 3,000 2,400 Sales (in units) Production (in units) Production costs: Variable manufacturing costs Fixed manufacturing overhead Selling and administrative costs: Variable Fixed $15,480 19,080 $10,320 19,080 12,000 11,000 12,000 11,000 Selected information from Lehighton's year-end balance sheets for its first two years of operation is as follows: LEHIGHTON CHALK COMPANY Selected Balance Sheet Information Based on absorption costing End of Year 1 Finished-goods inventory $5,760 Retained earnings 8,700 End of Year 2 $ 0 13,840 Based on variable costing Finished-goods inventory Retained earnings End of Year 1 $2,580 5,520 End of Year 2 $ 0 13,840 Year 1 Year 2 Sales revenue Cost of goods sold under absorption costing Subtotal Fixed manufacturing overhead as period expense under variable costing Total Operating loss under variable costing Add: Operating income under absorption costing Difference in operating income $ 0 $ $ 0 $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts