Question: 1 Record the adjusting entry for rent expense. 2 Record the adjusting entry for supplies expense. 3 Record the adjusting entry for interest revenue. 4

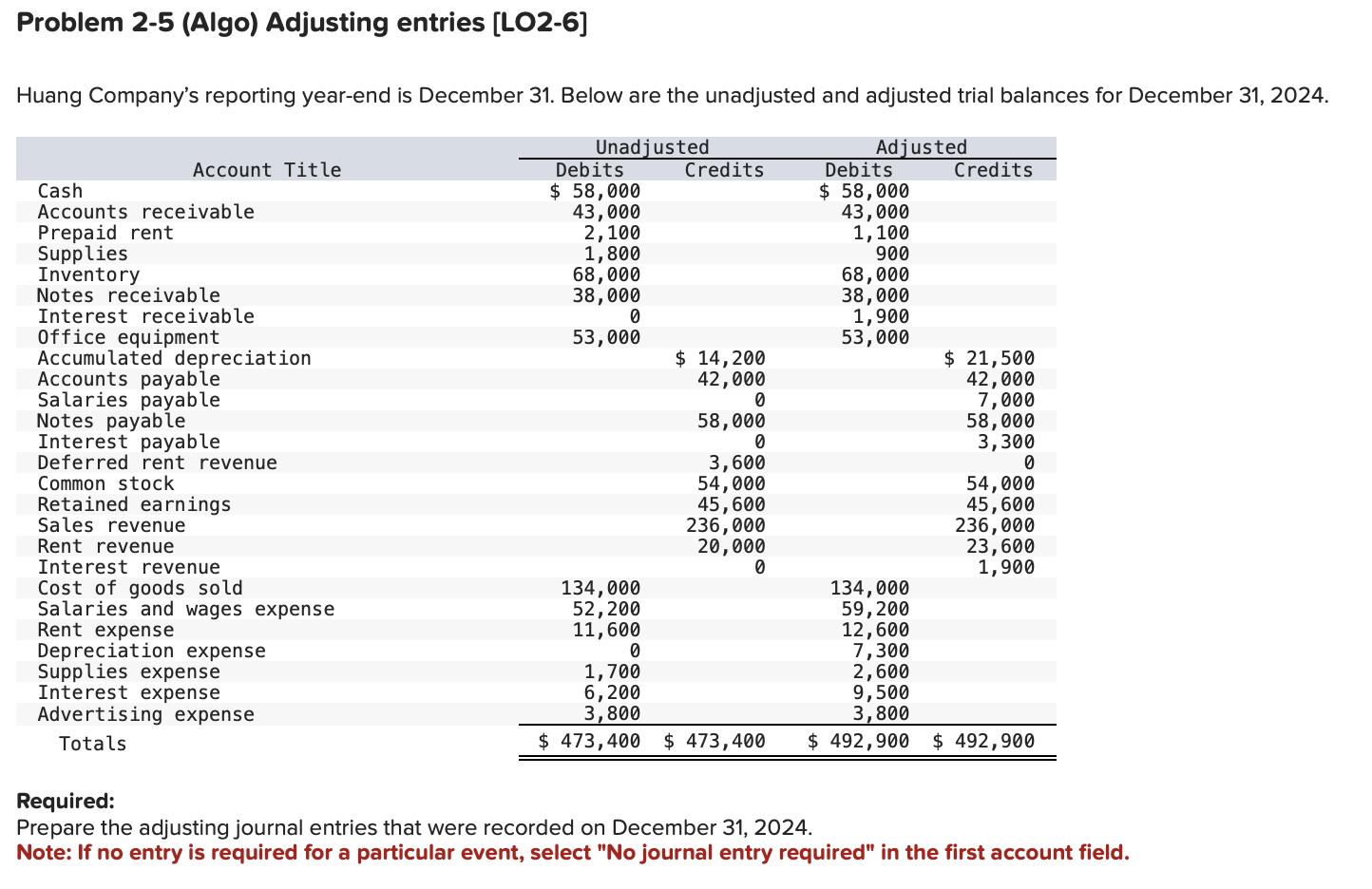

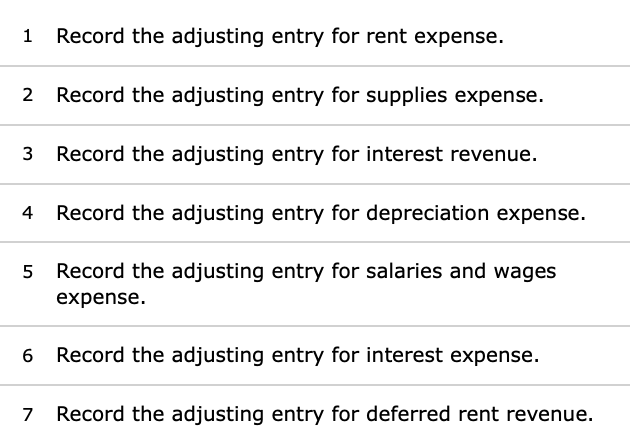

1 Record the adjusting entry for rent expense. 2 Record the adjusting entry for supplies expense. 3 Record the adjusting entry for interest revenue. 4 Record the adjusting entry for depreciation expense. 5 Record the adjusting entry for salaries and wages expense. 6 Record the adjusting entry for interest expense. 7 Record the adjusting entry for deferred rent revenue. \begin{tabular}{|c|c|c|c|} \hline Transaction & General Journal & Debit & Credit \\ \hline 1 & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} Problem 2-5 (Algo) Adjusting entries [LO2-6] Huang Company's reporting year-end is December 31. Below are the unadjusted and adjusted trial balances for December 31, 2024. Required: Prepare the adjusting journal entries that were recorded on December 31, 2024. Note: If no entry is required for a particular event, select "No journal entry required" in the first account field

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts